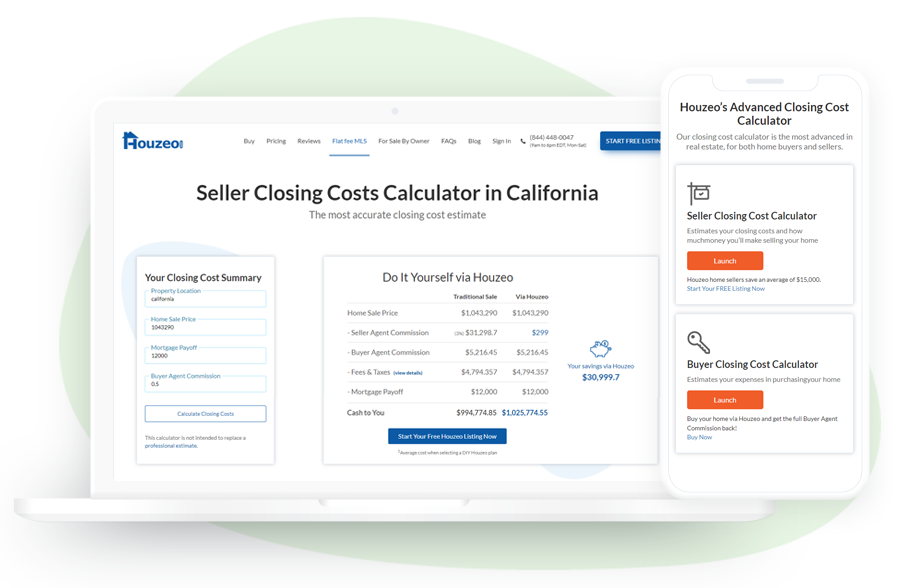

Seller Closing Cost Calculator

Estimates your closing costs and how much

money you’ll make selling your home

Our closing cost calculator is the most advanced in real estate, for both home buyers and sellers.

Estimates your closing costs and how much

money you’ll make selling your home

Estimates your expenses in purchasing

your home

Our calculator incorporates state, county, and city assessed taxes and other customary costs to give you a very detailed estimate

Houzeo Product Managers constantly review 100s of listings per week to enhance the calculators

Based on our learnings, our calculator informs you of costs that might not be customary so if they show up on your Closing Disclosure, you can question them

Houzeo is an advanced real estate tech platform that helps sellers ease the selling process. Apart from being the topmost For Sale By Owner (FSBO) and Flat Fee MLS platform, Houzeo also features properties up for sale for buyers.

Houzeo‘s Closing Costs Calculator allows sellers and buyers to determine the closing costs during the real estate transaction. Sometimes, the closing costs are also called the settlement costs. The closing costs vary for sellers and buyers and thus you will find two different launch buttons here.

How to calculate the closing costs for the buyer and seller?

The home closing costs vary from state to state, sometimes even from region to region, and that’s why it becomes a little frustrating to estimate how much exactly you will have to shell out on the closing expenses.

Houzeo’s Closing Costs Calculator will help you in getting the estimated amount of what you’d pay at the closure of the deal. It will estimate home closing costs for both parties i.e. the buyer and the seller.

Here’s what you need to do for calculating closing costs for the seller/buyer on Houzeo:

Select whether you are a seller or a buyer

Launch the service

Select city or county or state

Input purchase/sale price of the property

Enter the loan balance/down payment as required

Enter listing and buyer agent commission (if required)

Hit “Calculate My Closing Costs”

The closing costs calculator will analyze the current percentages for the state and the region and give you an estimation of how much you will have to pay as part of the house closing process.

Note: The way you pay the home closing costs is different. For a buyer, the mortgage closing costs are charged when the lender accepts the buyer’s down payment funds. For a seller, the home closing costs are deducted from the home’s sale price.

The sale price and the Realtor commissions are not the only costs that need to be considered when selling a house. “Closing costs” form an essential part of the real estate transaction. These expenses are incurred by both the seller and the buyer and are crucial to cater to before and at the closure of a deal. The closing costs consist of multiple components and vary for sellers and buyers.

A closing cost calculator helps calculate the approximate closing costs while selling and buying a house. As the closing costs vary for a seller and a buyer, the calculator is different for the buyer and the seller.

It should be noted that a property closing costs calculator depends on multiple factors which include the sale price, state/county in which the property is located, mortgage amount, and down payment.

While the lender provides a Loan Estimate form to the buyer explaining the closing costs, many real estate websites have started incorporating the closing cost estimator to help the buyers and the sellers proactively.

Buyers and sellers can match the closing costs against the Loan Estimate form to understand if there are any variations.

Note: A Loan Estimate form is mandatory to be provided to the buyer by the lender.

Also, a Closing Disclosure is provided three days before the closing. This contains the final closing costs. Having a closing costs calculator by your side can help you identify and be apprised of unknown costs at a later stage.

Note: The closing costs calculator can be even used by sellers as part of For Sale By Owner.

The closing costs for the seller can be anywhere between 8%-10% of the home sale’s price. While closing costs for the buyer can be anywhere between 3%-5% of the purchase price.

The closing costs vary across the states in the US and may get complex. These include both the selling and the buying closing costs.

Are Realtor fees included in the closing costs?

The higher percentage of seller closing costs is because of the fact that it includes hefty Realtor fees (which are on average 5%-6%). Thus, Realtor fees form a part of the closing costs and closing costs calculator.

Both sellers and buyers have to pay respective closing costs when finalizing a real estate deal. There are several closing costs available that need to be taken into consideration. The average closing costs depend on a number of factors.

Here is the classification of seller and buyer closing costs. You will also find these costs as part of Houzeo’s advanced closing cost calculator.

Typical closing costs for the seller include:

Seller Agent Commission

Buyer Agent Commission

Home Inspection Fee

Home Warranty Fee

Property Tax

Utility Bills

HOA Fees

Settlement Fee

Attorney Fee

Municipal Lien Search

Documentary Stamps

Title Insurance

Transfer Tax

A buyer’s estimated closing costs include:

Origination Charges

Origination Fees

Points credit/charge

Service Fees

Appraisal Fee

Credit Report Fee

Flood Certification

Home Inspection Fee

Survey Fee

Title Search and Lenders Title Insurance

Postage/Courier

Attorney, closing and settlement fees

Miscellaneous required services

Taxes and Government Fees

Recording Fees

Transfer Tax

Prepaids

Prepaid Homeowner’s Insurance premium

Upfront Mortgage Insurance premium

Prepaid Interest Charges

Escrow Payments

Escrow Homeowner’s Insurance

Escrow Property Taxes

Other Costs

Owner’s Title Insurance

The closing costs estimate is an important factor in the purchase deal. Proactively determining the closing costs can reduce the burden on sellers and buyers at a later stage.

Usually, buyers handle the closing costs. However, if negotiated, then the fees can be split between the stakeholders.

If a buyer makes an offer that has terms and contingencies, such situations can easily reverse the closing costs paying sides. Some sellers may offer to cover the closing costs in order to persuade buyers to remove the terms and contingencies from the contract. Sellers can also offer to pay the closing costs to quickly close the deal and move to their new home.

Thus, closing costs can be paid by any of the parties, as per the circumstances and negotiations. There can be countless reasons why the tables can turn at the time of an impending deal.

Usually, the seller pays 8%-10% of the purchase price in closing costs. Out of this percentage, a major chunk goes to agent commissions (up to 5%-6% of the home sale price). As the seller pays agent commissions for both parties, the seller has to pay more than the average closing costs. The rest 2%-4% is for taxes and fees. However, seller closing costs are deducted from the proceeds of the sale of the home at closing, so you rarely need to bring cash to closing.

Houzeo’s seller closing costs calculator determines all the closing costs as far as selling a house is concerned.

The closing cost estimator for the seller provides close enough values when compared with actual closing costs. All the region-specific data is pre-fed in the calculator to provide near-actual results.

Does the buyer pay closing costs?

A buyer pays at least 3%-5% of the purchase price as a mortgage or refinancing closing cost. Most of this amount goes to the lender to cover various kinds of mortgage/refinance-related fees and expenses.

Note: Some statistics state that a homebuyer needs to pay 2%-5% of the loan amount as closing costs.

Houzeo’s buyer closing costs calculator estimates all the closing costs as far as buying a house is concerned.

The closing costs for selling a real estate property draw a higher percentage than the closing costs when buying a house. This is because a good percentage of the closing costs go into the Realtor commissions.

An important thing to note is that the seller needs to pay both the listing and buyer agent’s commission. While listing agent commission is crucial for wide exposure of the property in the home selling market, the buyer agent commission is required to attract potential buyers.

Note: The closing costs described here are valid at the time of closing or before closing.

So, what is included in the seller’s closing costs? Here are the details of the estimated closing costs for the seller that are also included as part of Houzeo’s closing cost calculator. The details also include some of the common seller closing costs across states:

The selling or listing agent commission is the expense paid by the seller to the listing real estate agent. The listing agent will put your property up for grabs on the local Multiple Listing Service (MLS). This will give your property maximum exposure as all the real estate agents have access to the MLS.

Note: The seller agent commission varies across the states.

Most of the buyers are represented by real estate agents to search for properties. It is the responsibility of the sellers to pay the buyer agent commission to attract prospective clients. The better the percentage of commission, the better the chances of selling your house.

Note: The buyer’s agent commission varies across the states and is dependent on the seller.

A seller can opt for a home inspection to identify any major defects and issues in the house. The inspection can be handled before the property is even listed on the market. This is called pre-inspection. Else, a home inspection can also be done at a later stage just before the closing.

A home inspection can benefit both the seller and buyer and can help in a smooth closing process. Issues relating to water, mold, smoke detectors, important appliances, etc. should be tackled before you sell your house.

Some states make it mandatory to disclose the defects in the property. Also, a home inspection can be either undertaken by a seller or buyer.

Note: The average home inspection fee ranges between $200-$500.

A home warranty is one of the important expenses that sellers have to take care of. A home warranty fee is a fee that covers the maintenance cost of the devices and appliances available in the house. This is based on a time limit i.e. days, months, or years.

When selling a house, the seller needs to settle any pending related costs.

Property taxes are imposed by the local government on the owner of the house. The value of the property tax is dependent on the price of the property. It can be paid annually or at the time of the real estate transaction.

As per USA Today, the effective tax rate is 1.1% of the home value.

The owner needs to pay all the pending utility (electric, water, gas, etc.) bills before selling the house. As per Nationwide.com, a US family spends over $2K on utility bills per year which is a decent amount.

If the seller is part of the Homeowners Association (HOA), he/she will have to pay HOA fees which could be annual or monthly or as decided by the association. The HOA fee is used to manage and improve the properties which fall under its purview.

A settlement fee is a cost that the seller incurs against the settlement agent. A settlement agent could be a title company, an escrow company, or an attorney. Which settlement agent takes care of the process depends on the state your property resides in. These agents are required at the time of closing and form an essential part of the process.

A settlement agent helps transfer the ownership to the buyer and the respective amount to the seller. Apart from this, a settlement agent takes care of many other factors like title deed search (which costs around $200 but is dependent on the state average), liaison with all the parties involved to ensure all the clauses are met, attends settlement process, and much more.

A typical settlement fee varies between $350-$600 (dependent on the state).

Some states have attorneys as closing or settlement agents. A seller may also take the help of an attorney in legal matters. This depends on the seller. Most states do not require a real estate attorney and thus the attorney fees depend on if an attorney is hired by the seller.

A typical Attorney fee varies between $400-$700. The attorneys usually charge fees based on the number of hours.

A Municipal Lien Search will thoroughly investigate if there are any unresolved liens, permits, taxes, and utility bills relating to the property. Any unrecorded charges can result in a lien. The municipal lien search can help overcome any mistakes during the title search.

Any discrepancies in the title search can impact the buyer in the future. The municipal lien search can be undertaken by the title agent or company. Either the seller or buyer can go for the municipal lien search.

On average, a municipal lien search costs $200.

The documentary stamps refer to the excise tax on the documentation that transfers the property in a real estate transaction. It is like paying tax on a property deed or some other official documentation.

Title insurance protects the buyer if there is a discrepancy relating to the ownership of the property. The title search also takes care of factors like any back taxes, liens, ownership clauses, etc.

There are generally two types of title insurance – owner’s title insurance and lender’s title insurance.

The seller primarily pays the cost of the owner’s title insurance to protect the buyer. The insurance covers discrepancies like wrong ownership or false documentation. This is also important in case the title company has not done its work correctly.

The title insurance cost is decided by the state and is based on the property’s value. Also, who opts for title insurance and pays for it can be negotiated between the seller and the buyer.

The HOA Estoppel letter is the document that is provided by the Homeowners Association. It is a legally binding document that details any dues that the buyer will have to pay after closing that is owed by the seller.

An HOA Estoppel fee needs to be paid by the seller as part of the process. This ranges from $200-$500.

What is the transfer tax?

The real estate transfer tax is the tax levied when there is the transfer of property from one individual to another. It is a kind of transaction fee that is imposed by the state, county, or municipality. The transfer taxes are crucial in a real estate transaction but are dependent on the state. Some states levy transfer taxes while some do not.

Who pays transfer tax?

Transfer tax can be paid by either seller or the buyer. This depends on the negotiations. In some cases, the tax is even split up between the parties.

How does the calculation of transfer tax happen?

The transfer tax is either a defined percentage of the sale price or is calculated based on a defined amount. For example, in North Carolina, the transfer tax is $1 per $500.

Just like seller closing costs, buyers too have to take care of home buying closing costs. A buyer’s estimated closing costs can be anywhere between 3%-5% of the loan amount. The closing costs when buying a house are composed of multiple costs similar to the seller’s closing costs.

A home buyer also receives a Closing Disclosure which is usually a 5-page document and consists of important aspects of the loan including the closing costs.

In this section, we will discuss the typical buyer’s estimated average closing costs during a real estate transaction. These closing costs are part of Houzeo’s buyer closing cost calculator.

What is an origination fee?

The origination fee is the amount paid by the buyer to the lender for processing the mortgage/loan including any overhead expenses. The fee is also known as the Loan Origination Fee. The loan officer addresses this cost at the beginning of the loan application process and thus forms a part of the closing costs.

The origination fees also include the application fee and prepaid interest. This fee is generally split into:

Application Fee: For collating the documentation and application.

Underwriting Fee: For checking if the application is in place and the buyer is qualified for the loan.

How much are loan origination fees?

The loan origination fee typically ranges between 0.5%-1% of the loan amount. Though this may vary between states.

Is the origination fee tax deductible?

Yes, the loan origination fee is tax deductible.

Is the origination fee the same as the points?

If you are talking about discount points, then No! Discount points is the fee that can be paid to lower the interest rate and thus the monthly mortgage amount.

These are generally 0.25% of the loan amount. Points and lender credits can be traded off for mortgage and closing costs. The points here refer to the discount points which help lower the interest rate in exchange for paying an upfront fee.

Points are calculated as per the loan amount. Each point is equal to one percent of the loan amount. The more points you pay, the lower the interest rate will be.

What is the appraisal fee?

An Appraisal officer or manager does market research and evaluates the price of a specific property. The appraisal manager ensures that a correct price is offered by the seller and is as per the market value. The appraiser is usually hired by the lender and is given an appraisal fee.

The evaluation can help the buyer understand if he/she is paying the right amount for the property. In case of any discrepancies, the buyer can back out or go for re-negotiations with the seller.

As part of the appraisal process, the appraiser checks the property size, neighborhood, and features of the house to derive the right home value. The appraiser takes special care to identify similar properties in the area to derive the optimum home value.

When is the appraisal fee paid?

The appraisal fee is paid by the buyer before the closing process, specifically after the owner has accepted the offer.

How much is an appraisal fee?

The average appraisal cost in the US ranges from $375-$450.

The bank/lender can ask for a credit report fee from the buyer to purchase the credit report of the buyer from one of the credit agencies. The credit report gives an overview/background of the buyer. It tells about credit cards, loans, and if the buyer pays the bills timely.

A credit report fee should not cost you more than $30.

The lenders often require buyers to buy flood insurance as a backup in case there is a flood risk in the area. The flood certification is thus an important document for the lender. The high flood-risk areas are marked by the Federal Emergency Management Agency (FEMA).

FEMA provides an elevation certificate that determines the flood risk of the home and also helps in reducing flood insurance costs.

The flood certification costs around $15-$20.

What is a home inspection?

Home inspection relates to a thorough check of the property to identify if there are any damages. These damages may include electric damages, bathroom damages, kitchen damages, appliance damages, etc. The home inspector defines the inspection checklist before he/she visits the property.

The lender usually hires a home inspector to check on the condition of the property. A buyer needs to pay for the inspection.

How much does a home inspection cost?

The home inspection fee, on average, can cost anywhere between $100 and $150.

The survey fees for buying a house are paid to the survey company. The buyer or lender hires a survey company to identify the boundaries and dimensions of the property. The company also provides the structure of the house and easements. Topographical details like drainage, gas lines, water line, etc can also be included in the survey report.

The average survey fee for buying a house is around $500.

A lender’s title insurance and home title search are required to protect the lender and buyer in case there is a discrepancy in the ownership of the property.

There can be a dispute where someone can claim his/her right over the property. In such a case, a house title search comes into the picture and protects the owner (prospective buyer) from property disputes.

The title company usually takes care of the title of the property and has complete access to the ownership history.

The cost of a title search ranges from $75-$200.

In case there is a flaw in the title that was not catered to by the title company, the title insurance will protect the buyer and the lender from any unwanted legalities, damages, harm, and dues.

The lenders title insurance (for lender) fee and owners title insurance (for buyer) fee thus form an important part of the closing costs. The title fee is also known as the title settlement fee.

A real estate transaction requires a lot of paperwork. The lender may hire a courier to carry documents and deliver them to the buyer.

The postage and courier services may cost up to $60.

To handle the paperwork and legal matters in the real estate transaction, the buyer may need to hire an attorney. Though in many states an attorney is not required, buyers might still want to hire to tackle the legal issues and processes.

In some other states, an attorney acts as a closing or settlement agent which makes it mandatory for the buyers to deal with attorneys. In any case, working with an attorney is a good bet.

Real estate attorney fees for closing can be negotiated in the contract. On average, an attorney can cost you anything between $500-$700. Though, the fees of the real estate attorney depend on the state or county, or even city.

There could be multiple services offered by the lender that don’t fall in any of the sections. These are tagged as miscellaneous required services under Houzeo’s closing costs calculator.

Also, a title company may charge fees for title search, examinations, notary fees, recording fees, and much more. Any such miscellaneous closing costs can be found as part of the Miscellaneous Required Services bracket in Houzeo’s buyers closing cost calculator.

Note: The miscellaneous closing costs mentioned here are not related to the Realtor fees.

In simple terms, recording fees are the amount paid to the government to record the change of ownership of the home.

Recording fees are usually charged by the local authorities where the change of ownership happens. The recording fee closing cost fluctuates from one region to another. Recording implies documenting the deed/contract with the authorities and is paid during closing.

The following documents are required for the recording fee:

Mortgages

Changes of title

Deeds

Bills of sale

Claims of lien

What is the transfer tax?

The real estate transfer tax is the tax levied when there is the transfer of property from one individual to another. It is a kind of transaction fee that is imposed by the state, county, or municipality. The transfer taxes are crucial in a real estate transaction but are dependent on the state. Some states levy transfer taxes while some do not.

Who pays transfer tax?

Transfer tax can be paid by either seller or buyer. This depends on the negotiations.

How does the calculation of transfer tax happen?

The transfer tax is either a defined percentage of the sale price or is calculated based on a defined amount. For example, in North Carolina, the transfer tax is $1 per $500.

What is homeowner’s insurance?

Homeowner’s insurance is the insurance that covers your house against any internal and external damages. The homeowners need to buy the policy for this which requires paying the insurance premium annually or at regular intervals to keep the policy active.

Pre-paid homeowner’s insurance premium allows the buyer to submit the premium in advance at the time of closing. The onus of insurance lies on the buyer who would be the new homeowner.

The lender often asks buyers to buy homeowner’s insurance for protection. The insurance covers the property in case of any damages by external sources, theft, or even during natural calamity.

The premium is based on the policy amount and can vary from a few hundred to thousands.

Is homeowners insurance tax deductible?

The homeowners insurance is generally not tax deductible.

Is homeowners insurance required?

You are not required to have homeowners insurance but it is required by banks in case of a mortgage.

Depending on the down payment, the lender may require you to pay mortgage insurance. The up-front mortgage insurance premium is a one-time fee that is paid to the lender when you close on a Federal Housing Administration (FHA) loan.

What is a mortgage insurance premium?

A mortgage insurance premium protects the lender in case the borrower is not able to pay back the loan amount.

How much is the mortgage insurance premium?

The upfront mortgage insurance premium is 1.75% of the loan amount and is part of Houzeo’s closing costs calculator. The premium may also be included as part of the monthly mortgage payments.

Note: Mortgage insurance premium falls under tax deduction.

Prepaid interest is what is paid before the scheduled debt repayment. This is paid by the buyer to the lender. The interim purchase interest charge is calculated from the day of the settlement to the beginning of the first mortgage payment.

Lenders require the buyers to place some amount in the escrow towards the homeowners insurance. This is to cover the costs in case the buyer is not able to pay for the insurance. A buyer may run into financial trouble or other issues due to which he/she may not be able to pay the costs. This is where homeowners insurance in escrow comes into the picture.

Similar criteria can also be applicable to property tax. Escrow Homeowner’s Insurance for 2 months requires the homeowner to deposit an insurance premium of up to 2 months in advance in the escrow.

Do I have to pay homeowners insurance through escrow?

Yes. The buyer requires to put 2 months of homeowner insurance amount in the escrow.

Government can place liens or foreclose on houses with unpaid property taxes. Lenders thus make sure that the borrowers take care of the property taxes. Tax liens have priority over mortgage liens and thus the government can take over the property if the taxes are not paid.

Putting advance property taxes in escrow gives lenders some leverage if the borrower is not able to pay them due to various reasons.

What is the owner’s title insurance?

The owner’s title insurance protects the buyer against title discrepancies once he/she owns the house. There could be scenarios where someone might file a case claiming the property to be his/her before the buyer purchased it. Or, a contractor may sue the homeowner for not paying the previous dues. In such cases, the buyer will get affected.

The title insurance for the owner can be purchased via a title insurance provider. Similarly, the lender’s insurance protects the lender in case any property dispute happens.

One of the most common questions relating to closing costs is whether they are tax deductible or not for seller and buyer?

Tax deduction relates to claims made in order to reduce taxable income. Following are the closing costs that are tax deductible:

Property Tax

Pre-paid Interest

Points

Origination Fees

Mortgage Insurance Premium

The closing costs cannot be waived as they play an important role in the real estate transaction. Both sellers and buyers have to take care of multiple closing costs. These closing costs can be negotiated and reduced but not completely waived.

From the seller’s perspective, a major percentage of the closing costs goes into Realtor commissions. Though the listing agent commission can be saved potentially using Flat Fee MLS platforms like Houzeo, the seller still has to pay buyer agent commission to attract buyers.

Among other fees, a seller might negotiate with an Attorney (if hired) for his/her fee. The seller may also look for title companies at affordable prices to lower the closing costs.

From the buyer’s perspective, multiple closing costs form part of the deal. The lender usually provides a Loan Estimate that has an overview of the closing costs. These closing costs, again, can’t be waived, but efforts can be made to reduce them.

Here are some of the ways using which you can control the closing costs:

Lender with low closing costs: A buyer can shop for the best lender in the town that works with low closing costs. In fact, the buyer can ask for quotes from multiple lenders and finalize on one that offers the lowest closing costs.

Check the loan estimate: As a buyer, you should always have a thorough look at the loan estimate. The pricing should be optimum and there should not be an additional cost that is not relevant. Also, the buyer should identify if there is any discrepancy like the same cost added twice under different names.

Negotiate with the lender: The buyer can negotiate with the lender to remove the unwanted and unknown costs from the Loan Estimate. Also, the buyer should ask for the Closing Disclosure form from the lender and compare the values with the Loan Estimate to identify discrepancies.

Ask sellers: The most straightforward way to reduce the closing costs for the buyer is to request the seller to reduce the sale price. If not, as per the negotiations and understanding, some sellers do take care of some of the closing costs for buyers. This is done to smoothen the transaction.

Prepaid Interest Charges: You can minimize interest charges by settling/closing at the end of the month. The interest is accrued between the settlement date and the beginning of the first mortgage payment. If this is close to the month end, less interest would accrue.

Saving on Points: If the loan is already defined with a low-interest rate, there is no need to buy on Points which also reduces the interest rate.

Recent Appraisal and Inspection: If there has been a recent appraisal and inspection of the property, the buyer can ask the lender to waive both the fee.