Delaware home prices rose another 7.3% in Jan 2025, reaching $339,700. If you’re looking to sell your home, now is a great time. But record home prices also mean record Realtor commissions. On a typical Delaware home, you’ll pay up to $20,000 in commission.

But it’s 2025. Selling a house in the Diamond State is easier than ever. You don’t need a full-commission Realtor to get top dollar for your home. Follow these simple steps to list on MLS in Delaware, attract buyers quickly, and save thousands!

Selling Your Home in Delaware: 8 Simple Steps

Delaware’s low taxes and charming coastal towns attract homebuyers looking for affordability. In fact, Delaware ranks 5th for net migration, with Wilmington attracting buyers for its waterfront properties.

To make the most of this growing demand, follow this step-by-step guide to selling a house in Delaware and close in days, not months:

Step 1: Prep Your Home for Sale

97% of agents believe that curb appeal can speed up your sale. Keeping your lawn tidy is a great start, but don’t stop there—inspect for pest infestations. Delaware’s coastal climate can attract bed bugs, cockroaches, and mosquitoes, which can be a major turn-off for buyers!

You can also carry out a pre-listing inspection to uncover other issues in your property. A home inspection in Delaware typically costs between $350 and $425.

Step 2: Choose How to Sell Your House

Here are 4 options you can consider when selling a house in Delaware:

- Discount Real Estate Brokers: They offer services like contract review and negotiation for a lower fee than traditional agents. Delaware discount real estate brokers charge between 0.5% and 2% as commission.

- Full-Service Realtors: They provide various services from listing to closing, but charge a hefty 5% to 6% commission. In today’s digital age, you can skip the agent and handle most of these tasks yourself, saving you thousands.

- Cash Buyer Companies: Selling to an iBuyer or a cash buyer is one of the best ways to sell your home fast in Delaware. However, you may get lowball offers, ranging between 30% and 70% of your home’s Fair Market Value (FMV).

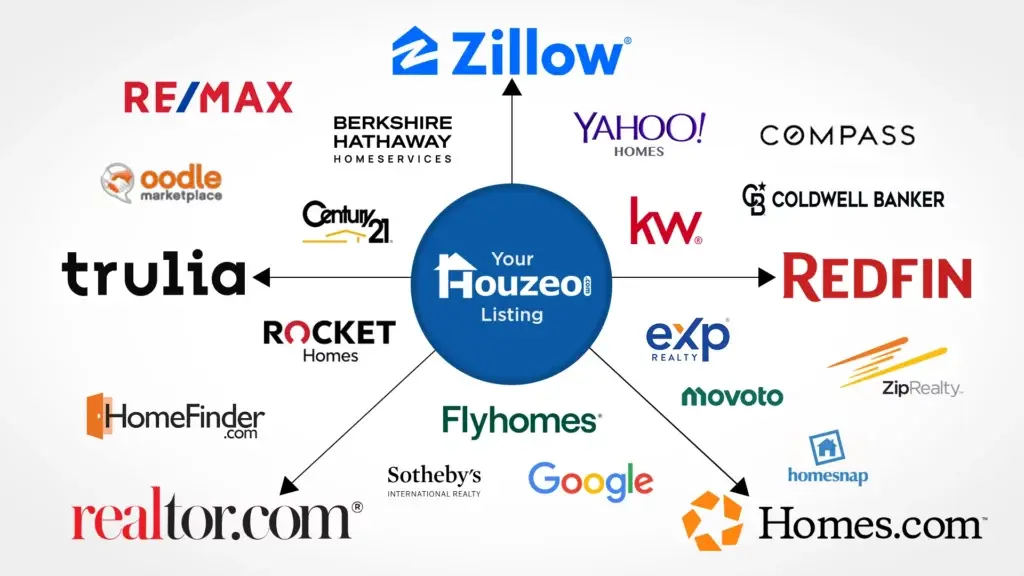

- Flat Fee MLS: If you sell your house with Delaware Flat Fee MLS listing companies, your home will be on the MLS for just $399. Your property will also be on top websites like Redfin and Trulia.

Step 3: Price Your Home Competitively

27.7% of DL sellers had to drop their homes’ asking price in Jan 2025. Inaccurate pricing forced them to stay longer on the market and probably cost them top-dollar offers.

While in a seller’s market, you could price your home up to 10% more than its market value, With only 2 months of supply, Delaware is a seller’s market. Homes spend an average of 39 days on the MLS. So, you can price your home 10% above its market value.

Step 4: Make Your Home Market-Ready

A visually appealing home has a higher likelihood of getting multiple offers. Here’s what you must do to get a market-ready property:

- Stage Your Home: Staged homes sell 70% faster and for 17% above the asking price. A curated decor and organized layout help buyers visualize living in the home.

- Invest in Professional Photography: Delaware real estate photographers can showcase your home’s unique features that increase the impact of your listing. A well-captured waterfront property is sure to grab the attention of potential buyers.

Once your home is market-ready, don’t wait any longer. Get it on the MLS immediately!

Step 5: Market Your Property Effectively

Whether it is a ranch house or a cozy condo, you must showcase your home’s unique features to attract the right audience. Here’s what you can do:

- Craft a Captivating Property Description: A catchy headline with an engaging description will draw buyers’ attention. Use popular adjectives like “modern,” “spacious,” and “new” to make your home stand out.

- Host Open Houses: The best way to connect with potential buyers is by hosting an open house. In fact, 4% of homebuyers found their dream home through an open house. Schedule them on weekends to attract larger crowds and increase your chances of getting more offers.

- Add a Yard Sign: 35% of buyers found their homes because of these signs in 2021, which are relevant even today. FSBO yard signs will feature your name, contact details, and property description.

Step 6: Handle Showings and Offers

After your Delaware home is listed, ensure that it is staged and ready for showings. The more presentable your home is, the more likely you are to get offers. And don’t settle for the first offer you get. Consider these factors before making a decision:

- Is the buyer making a cash offer on your house?

- Has the buyer applied for a mortgage? Is it pre-approved?

- Is the buyer willing to waive off some contingencies like home appraisal?

Step 7: Close the Deal

Once you’ve finalized an offer, you can move towards closing the deal. Here are some costs you’ll need to pay when selling your house in Delaware:

- Transfer Tax: This is a one-time fee that’s paid when transferring ownership. The transfer tax generally costs less than 1%.

- Property Tax: You are generally charged approximately 1% of the total home sale value. You can also claim a rebate if you have paid your property tax a year in advance.

- Closing Costs: You and the buyer pay separate closing costs. Seller closing costs in Delaware include HOA, real estate attorney, and home warranty fees.

Step 8: Transfer the Ownership

To transfer ownership to the buyer, you must sign the escrow paperwork, title deed, and other documents.

Once the formalities are complete, the buyer transfers all the funds to the escrow, and the escrow company transfers the funds to you. The process is officially concluded when the buyer’s name is registered in the public record.

Should I Sell My Delaware Home Now?

Yes! With rising home prices, now is the best time to sell a house in Delaware. Despite heat waves, Delaware’s zero state income tax still makes the state appealing to many. Plus, with retirees flocking in for the coastal charm, you’re sure to get a great price for your home

Frequently Asked Questions

What are the closing costs when selling a house in Delaware?

Home sellers pay 6.25% to 9% as closing costs in Delaware. It usually includes HOA fees, escrow fees, real estate attorney fees, and home warranty fees.

What is the best way to sell your home in Delaware?

When you sell your home with a Delaware Flat Fee MLS company, you not only save thousands of dollars on agent commission but also get easy access to the MLS.

How do I handle multiple offers on my Delaware home?

When handling multiple offers, evaluate each offer carefully, consider competitive pricing, contingencies, and closing timeline.

» Highest and Best Offer: Learn how to handle a multiple-offer situation like a pro.

What are the steps to selling a home in Delaware?

When selling a house in Delaware, you must prepare your home for sale, price it competitively, market it effectively, negotiate offers, and close the sale.

» How to Sell a House in Delaware: Your 8-step action plan for selling a house in the Diamond State.