In the current market, where sales have declined by 4.7%, seller concessions can be a powerful strategy. Over one-third of homeowners offered seller concessions in 2023!

Seller concessions are a portion of the buyer’s closing costs that a seller agrees to pay while selling a house. These concessions sweeten the deal for both buyers and sellers. They help you sell your house fast by providing the buyer with an appealing bait.

What are Seller Concessions?

Seller concessions in real estate are transactions where the seller agrees to contribute towards a portion of the buyer’s closing costs.

These costs may include:

- Assistance with buyer’s closing costs like loans, fees, or appraisal costs.

- Repair credits — so the buyer can handle repairs after the sale.

- Mortgage buydowns to reduce the buyer’s interest rate.

- A one-year home warranty to cover major systems and appliances.

Why Would a Seller Pay Closing Costs?

For numerous reasons! With seller concessions, you can make your property more appealing to buyers. You can also close the deal faster.

Usually, it is the buyer who pays the closing costs. However, this isn’t set in stone. As a seller, you can offer to pay a part of the closing cost to lock in a deal that favors you.

How Much Do Sellers Pay in Closing Costs?

Typically, a seller pays 8% to 10% of the sale price. The closing cost for sellers depends on several factors, such as the house’s location, lender costs, terms of sale, and buyer-seller negotiations.

The expenses involved in the seller’s closing costs are:

- Agent Commissions: Costs between 4% and 6% of the sale. However, you can work with a discount broker and pay a low commission of up to 2%.

- Transfer Tax: The amount of transfer tax depends on the state in which you are selling a house.

- Title Insurance: The cost of title insurance ranges between 0.5% to 1% of the sale price. It protects new homeowners’ rights from any future disputes.

- Escrow Fees: Escrow companies charge either a flat fee or around 1% of the home sale price. They manage the real estate transactions up to closing.

- Prorated Property Taxes: These are the taxes you owe for the period you stay in your house during the year of sale.

What Are the Pros and Cons of Seller Concessions?

Consider the following factors before you choose to offer seller credit:

Pros

- Attract More Buyers: Seller assist can help you broaden the pool of potential buyers. This is because it reduces their financial burden.

- Make a Quick Sale: Seller concessions cover the gap when the buyer struggles to pay closing costs; this can expedite the home sale process.

Cons

- Reduced Net Profits: Seller credits can negatively impact your net sales profit. The concession amount could impact your financial planning.

- Negative Perception: Concessions can imply that the property has some issues and you are desperate to sell it fast. This perception can make the house sit on the market unsold for a longer time.

- Higher Costs: Seller concessions may mean you cannot set a high selling price. Since closing costs are a percentage of the sale price, a higher selling price will mean higher closing costs for you.

Are There Limits on Seller Concessions?

Yes. The sale price or the appraised home value dictates the seller’s concession. It also depends on lender guidelines and market conditions.

Loans with Limits on Seller Concessions

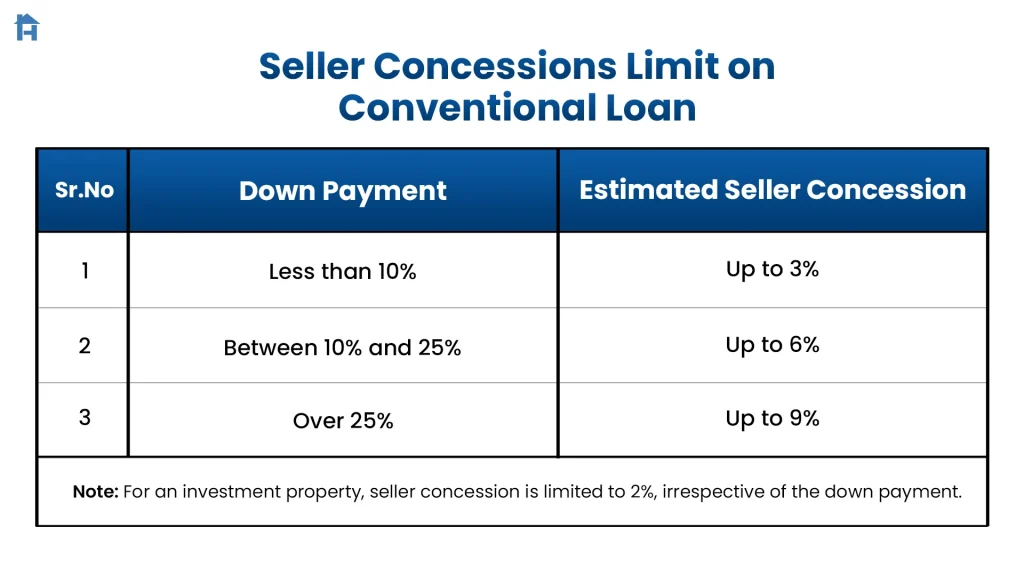

The limit on the seller’s credit varies depending on the type of loan. Generally, conventional loans have stricter limits than government-backed loans.

Conventional Loans

The maximum concessions allowed for this type of loan is 2% to 9%. The exact limit depends on the buyer’s down payment amount.

FHA Loans

You are allowed to contribute up to 6% for FHA loans. This percentage is calculated based on the agreed-upon sale price or the appraised value, whichever is lower.

VA Loans

VA loans permit seller concessions up to 4%. However, these concessions must not include the buyer’s normal closing costs like appraisal fees, credit report fees, etc.

USDA Loans

You can pay up to 6% of the home’s purchase price in USDA loans. However, these guidelines and limits are subject to change over time.

Should You Consider Seller Concessions?

Yes! Seller concessions can be a win-win solution in today’s real estate market, where buyers face rising costs. You can contribute to these costs to make a speedy sale.

If you choose to offer concessions, consider going FSBO to make your sale even smoother. List on the MLS for a flat fee to reach more buyers and save on commissions!

Frequently Asked Questions

What is a seller credit in real estate?

Seller concessions or credits are the portion of the buyer's closing costs that the seller agrees to contribute. It is a negotiation tactic to attract buyers and make a quick sale.

What is the most a seller can pay in closing costs?

Seller's closing costs typically range from 8% to 10% of the sale price. However, this depends on the loan type and lender rules.

Are seller concessions to buyer tax deductible?

Yes. Seller concession is a sales expense the home seller encounters when selling a house. So, it is tax-deductible.