Traditionally, homeowners paid 5% to 6% in real estate commission in Florida, split between the listing agent and the buyer’s agent. However, after the NAR settlement, the buyer’s agent fees are now negotiable—potentially saving you 3%!

But there’s more! With a Flat Fee MLS service in Florida like Houzeo, you save another 3%. Your home gets listed on the MLS for a fraction of what you’d pay to a Realtor! This way, you save a whopping $24,684 on a $410,800 Florida home. Plus, you get maximum exposure and control over the costs!

What Is the Real Estate Commission in Florida?

The average real estate commission in Florida is around 5% to 6%, which includes listing agent and buyer’s agent commissions. The average real estate agent commission vary depending on location, property type, and market conditions.

Who Pays the Realtor Fees in Florida?

Typically, home sellers pay the real estate commission in Florida. The commission is split between the listing agent and the buyer’s agent. The commission is deducted from the seller’s proceeds at closing.

However, the new Realtor law allows for more flexibility in how a buyer’s agent is compensated. Buyers may now directly pay their agent, either through a separate agreement or as part of their overall transaction. Also, sellers may offer seller concessions if the housing market is in the buyers’ favor.

NAR Settlement and the New Laws: What’s Changed?

The NAR Settlement went into effect on August 17, 2024. Buyer’s agent commissions can no longer be offered on the MLS. This means sellers will save thousands, but it also means there are a lot more compliance and litigation risks.

Here’s what this means for you:

- Sellers Can Save Thousands in Commissions: You will likely pay lesser than the traditional 3% buyer’s agent commission. Because it will be negotiated twice: first when buyers hire their agents, and when sellers review offer contracts.

- Seller Priority #1 Will Be Paperwork: The buyer’s agent mitigates risks related to seller disclosures, offer contracts, contingencies, closing, etc. They ensure your paperwork is legally compliant and adheres to MLS rules.

- Negotiations Can Now Feel Like Haggling: Buyer’s agent commissions are now included in offer contracts. Buyers may request sellers to cover the commission rates as concessions. That means home buyers and sellers alike will negotiate commissions.

- Buyer’s Agent Commissions Can Be Offered Offline: Buyer’s agent fees can still be offered outside of the MLS. They just cannot be advertised on the MLS.

Cost Comparison: With and Without a Listing Agent

You could save up to $10,086 when selling a median-priced $411,400 home with a Flat Fee MLS service in Florida.

Suppose, you are selling a house in Florida priced at $411,400. Assuming you pay a 3% commission fee, you’ll pay $12,342 to your listing agent. With Houzeo, you could reduce that cost significantly by paying only $199 with 0.5% at closing.

| Service Provider | Fee | Commission Due | Savings |

| Traditional Agent | 3% | $12,342 | $0 |

| Houzeo | $199 | $2,256 | $11,578 |

Alternatives to Florida Real Estate Commission

If you’re looking for an affordable alternative to an agent-assisted sale, here are a few options to consider:

- List With a Discount Real Estate Broker: Many discount real estate brokers in Florida provide all the services traditional Realtors offer but at discounted rates. They usually charge 1% to 1.5% commissions to list your home.

- Sell as FSBO: With For Sale By Owner websites in Florida, you can sell your home online, review contracts, and schedule showings all at your fingertips. You also get paperwork and negotiation assistance.

- List for a Flat Fee: Florida Flat Fee MLS companies can list your property on your local MLS within 24 to 48 hours. Also, you can get top dollar for your house.

- Sell to an iBuyer or Cash Buyer: A cash buyer can make an instant cash offer and help you sell your house fast in Florida. iBuyers have strict purchase criteria but can make cash offers as high as 80% of the Fair Market Value.

How to List on the Florida MLS With Houzeo and Save on Commissions?

Here are 5 easy steps to save thousands of dollars and have your MLS listing active within 24 to 48 hours:

- Create an Account: Visit Houzeo.com, download the Houzeo Mobile App, and click “Start Listing Now.” Provide basic details such as your name and contact information to set up your account.

- Enter Property Information: Log in to your Houzeo dashboard and click “Sell a Property.” Provide details about your home, such as the number of bedrooms, bathrooms, and any standout features.

- Set Your Asking Price: Use Houzeo’s home worth calculator to determine your home’s market value. Then set a competitive price for maximum benefit.

- Choose a Flat Fee MLS Plan: Houzeo offers four flat fee MLS plans. Select the plan that suits your needs.

- Prepare Your Listing: Add aesthetic and non-personal photos to showcase your home’s best features to attract potential buyers. After this you need to sign the listing agreement.

» Houzeo Reviews: Find out why Houzeo is one of Florida’s best Flat Fee MLS listing services.

What’s the Best Way to Save on Realtor Commissions in Florida in 2025?

The best way to save on commissions is to opt for Flat Fee MLS Listing services like Houzeo and eliminate the 3% listing agent fee. When you sell a house by owner in Florida, you also get complete control over the sale.

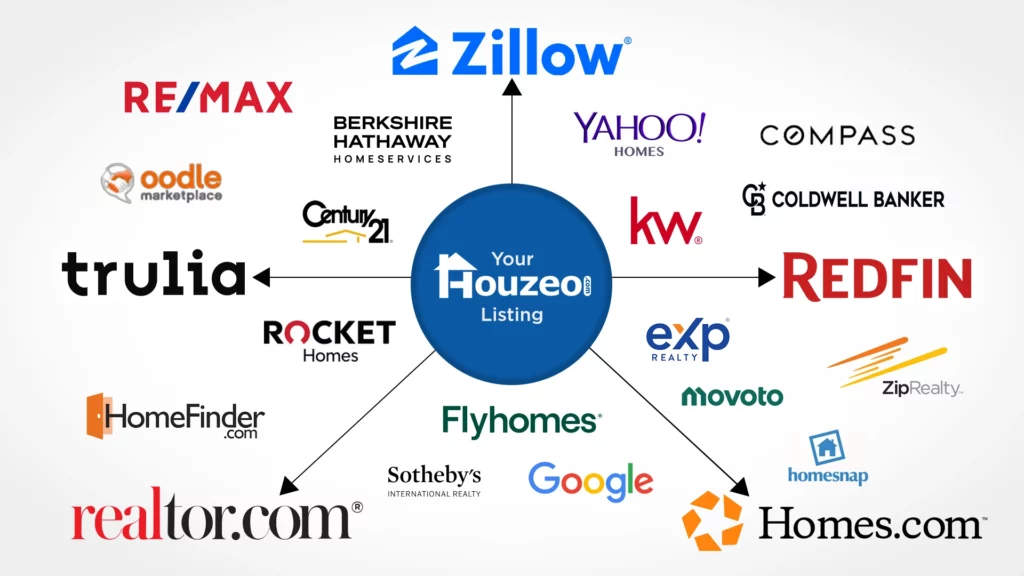

With Houzeo, your home can be on the MLS within 48 hours. You will also get 24/7 customer support. Besides this, your listing will get maximum exposure via top real estate websites like Zillow, Trulia, Redfin, and more.

Frequently Asked Questions

Who pays Realtor commission in Florida?

Usually, sellers pay the Realtor commission in Florida. However, after the NAR settlement, sellers are no longer obligated to pay the buyer's agent commission.

What are the new real estate commission rules and regulations in Florida?

The new real estate commission law made buyer's agent commission negotiable in Florida. After the NAR Settlement, sellers can now save more. Earlier, they were responsible for covering both the listing and the buyer's agent fees. Now, buyers handle their agent’s fee directly.

How much does a Realtor make in Florida?

Realtors in Florida typically earn a real estate commission of around 5% to 6% of a home's sale price. The commission is split between the listing agent and buyer's agent. However, their actual earnings can vary depending on the market conditions, property type, and location.