✏️ Editor’s Note: Realtor Associations, agents, and MLS’ have started implementing changes related to the NAR’s $418 million settlement. While home-sellers will likely save thousands in commission, compliance and litigation risks have significantly increased for sellers throughout the nation. Learn how NAR’s settlement affects home sellers.

Only 33% of Americans have established a plan for their estate. Having a will for your assets can make things easier after you pass away.

The probate process ensures a fair asset distribution among the beneficiaries. But, if you die without a will, things can be more complex and costly for your inheritors.

On the other hand, putting your house in a trust is a mindful choice to safeguard your assets. This ensures the safety of your assets and a proper distribution after your death.

Key Takeaways

- What is Living Trust? A living trust is a legal method of property planning you can use during your lifetime.

- Benefits of a Property Trust: Setting a trust can reduce the value of your estate and save you estate tax. Additionally, trust have lower income tax rates than an individual.

- Important Types of Trust for Estate: The most important types of trust for passing your estate/property are revocable and irrevocable trusts.

What Is A Property Trust?

A property trust is a legal institution. The homeowner (grantor) passes the property to the inheritor (beneficiary) through a property trust.

The trustee holds and manages the property under a deed between the trust and the grantor.

The original owner (grantor) appoints a successor trustee who can be a relative, friend, or attorney to manage the property after the grantor’s death. Typically, a successor trustee is the inheritor of the property after the grantor’s death.

» Selling an Inherited Property: Know How can you sell your inherited property.

What Are the Types of Trusts?

There are two important types of trusts:

Revocable Trust (Living Trust)

A revocable trust is also known as a living trust. In this form of trust, you are the trustee and you choose a successor trustee. The successor trustee inherits your estate after your death or incapacitation.

You can revoke this trust anytime during your lifetime. Additionally, you can make amendments to it or terminate it completely.

After the successor trustee inherits the estate the revocable trust becomes irrevocable. The successor takes control and manages the estate.

Revocable trusts are usually subject to estate taxes and don’t shield assets from creditors.

Irrevocable Trust

An irrevocable trust cannot be amended or terminated once it is established. You need the permission of the inheritor or a court order for it.

This trust transfers the ownership of your assets to the inheritor (beneficiary). You should carefully establish an irrevocable trust as you will no longer own the assets legally.

However, an irrevocable trust reduces the value of your estate which lowers the estate tax. Moreover, your assets are secured from creditors.

- We recommend you to consult an attorney before establishing an irrevocable trust.

How to Put a House in a Trust?

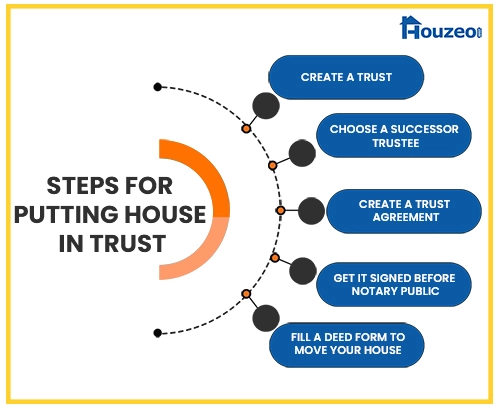

A trust executes a smooth transfer of the property to the beneficiary. If you wish to place your estate in a trust the following steps are included:

- Create a Trust: You need to establish a trust for placing your property for a smoother transfer.

- Choose a Successor Trustee: A successor trustee can be a family member, friend, etc. The successor will inherit the property after your death or incapacitation.

- Create a Trust Agreement: You need to create an agreement between you and the trust that includes the outlines of the trust.

- Signed Before Notary Public: The trust agreement needs to be signed before a notary public to make it legal.

- Fill a Deed Form: You need to fill out a new deed form to move your house into the trust. The state-specific property deed forms are available online.

Do You Need a Will If You Have a Trust?

No, if you have set up a trust then an estate will is not required. You can place all your assets into the trust. It is a faster and more efficient method for passing assets to heirs.

But creating a will is cheaper than a trust setup. It’s typical for well-planned estates to set up a trust for important assets like a house. A will can be made for the rest of the assets.

This helps to transfer essential assets quickly and the rest can be passed through the probate process.

- Imp: Property placed in trust does not has to go through a probate process. A probate process takes around 6 to 12 months to complete.

Putting a House in a Trust: Pros and Cons

There are several benefits as well as drawbacks of putting house in a trust:

Pros:

Putting your home in trust offers you the following perks:

- Skip Probate: The primary benefit of putting a house in trust is to the avoid probate process. A trust passes the ownership of the property privately after the owner’s death.

- Control Your Assets: After your death trust, a trust facilitates delaying asset distribution. You can hold off the assets until your children achieve a specified age or milestone (graduation, marriage, etc.)

- Protect Your Estate: Trust helps to protect your money from lawsuits, creditors, and ex-spouses.

Cons:

While trust benefits most situations, there are also reasons to avoid trust.

- Additional Fees: Setting up a trust involves an attorney. This incurs legal and ongoing administration expenses.

- Extra Paperwork: Putting a property in trust requires a transfer of the title of your house. This includes the signing of an additional deed.

- Complex Language: Trusts typically use specific language in their agreement. This can be difficult to understand for those who are unfamiliar with estate law.

Would You Put Your House in a Trust?

Placing your property in a trust can ensure a seamless transfer of ownership to your beneficiaries. A trust eliminates the probate process for your successors. Moreover, your estate is protected from lawsuits, creditors, etc.

A real estate attorney can make the process a cakewalk for you. However, creating a trust also depends on how big an estate you hold. A will can be a much cheaper alternative for smaller estates.

Eager to Know More About Houzeo?

Check out the following video to understand why Houzeo is one of the best for sale by owner websites in the U.S.

» NEED MORE CLARITY? Read these exclusive Houzeo reviews and learn why it is one of the best FSBO sites in America.

Frequently Answered Questions

What is the best type of trust to protect assets?

An irrevocable trust is a best to protect your assets from creditors and estate tax. However, an irrevocable trust does not allows you to make changes or terminate the trust.

Should I put my house in a trust?

Yes, you should put your house in a trust to make the property transfer more easy. Moreover, a trust makes a plan for your home's transfer after your death.

How Does Putting Your House in a Trust Work?

By putting a house in trust, you can skip the probate process. A trust helps to transfer your estate to your heirs much faster.

What are the disadvantages of putting you house in a trust?

The drawbacks of putting a house in trust are you need to pay extra costs and additional paperwork.

how to put your house in a trust, trusts and estates, should you put your home in a trust, revocable trust for house, putting my home in a trust, how to put a house in trust, putting a property in a trust, how to put your home in a trust, real estate trust account