A promissory note serves as a formal commitment from borrowers to repay their loans. It ensures secure and transparent financial transactions. As of Q2 2024, US mortgage debt hit $17.80 trillion and its delinquency rate rose to 3.2%.

This indicates that it has become hard for consumers to manage their finances. Given these factors, buyers should consider pre-approval to assess capacity and strengthen their position in a competitive market.

What Is a Promissory Note?

It is a legal document where a borrower promises to repay a loan to a lender under specific terms. Typically, it outlines the amount of the loan, the interest rate, the repayment schedule, and the maturity date.

If either the buyer or the lender breaches the terms, the other can take legal action to seek remedies. This provides clarity and legal protection to both the parties and enables smooth transaction.

What’s Included in a Promissory Note?

Here are the key components typically included:

- Parties Involved: Identifies the borrower and lender in the loan transaction.

- Date: Specifies when the agreement is drafted for record-keeping.

- Loan Amount (Principal): States the sum the borrower agrees to repay.

- Interest Rate: Details the fixed or variable rate applied to the loan.

- Repayment Schedule: Describes payment frequency, amounts, and total repayment.

- Maturity Date: Indicates when the full loan repayment is due.

- Collateral (if applicable): Lists assets securing the loan, such as real estate.

- Signatures: Requires both parties to sign for legal validity.

- Prepayment Clause: Explains terms for early repayment and associated fees, if any.

- Late Payment Penalties: Outlines charges for delayed or missed payments.

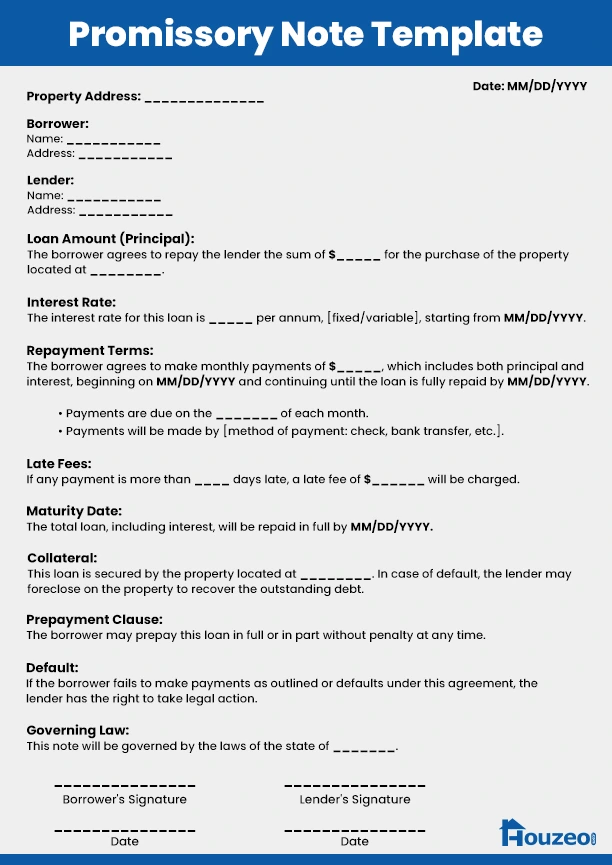

Here’s a Promissory Note Template for Mortgage:

When Do You Need to Use a Promissory Note?

It is necessary when a loan is involved, especially to document an agreement between a borrower and a lender. Common scenarios to consider a promissory note are when:

- You Opt for a Mortgage Loan: When you purchase a home with a mortgage, you’ll need to sign a promissory note that details your promise to repay the loan.

- You Refinance an Existing Mortgage: You will sign a new promissory note while refinancing , which replaces the old one. It establishes updated loan terms based on your agreement with the lender.

- You Secure a Private Real Estate Loan: If you borrow money from an individual or private lender to fund a real estate transaction, a promissory note is crucial for formalizing the terms of the loan.

- The Seller Offers Owner Financing: In some real estate deals, the seller might offer to finance the buyer directly. In such cases, the buyer should sign a promissory note to the seller, agreeing to repay the borrowed amount.

Types of Promissory Notes

1. Secured Promissory Note

This note is secured by collateral, such as real estate or a vehicle. If the borrower defaults, the lender can claim the collateral to recover the loan. These notes are typically used in mortgage agreements or auto loans.

2. Unsecured Promissory Note

This notes do not involve collateral. The lender relies solely on the borrower’s promise to repay. These notes are often used in personal loans but they come with increased risk for lenders, which often results in higher interest rates.

3. Master Promissory Note (MPN)

This allows students to borrow federal loans for several years with one agreement. It outlines the loan terms, which includes interest rates and repayment obligations, and consequently remains valid for up to 10 years.

4. Balloon Promissory Note

In this the borrower makes smaller periodic payments (usually covering interest) and then pays a large lump sum (the balloon payment) at the end of the loan term. It is often used in real estate or short-term business loans.

5. Installment Promissory Note

These notes require the borrower to make regular payments over time, which includes both principal and interest. Buyers commonly use this type of note in real estate transactions to make monthly mortgage mortgage payments.

6. Demand Promissory Note

This note lets the lender demand repayment anytime, with no fixed schedule. It often requires the borrower to repay on short notice.

How Promissory Notes Work in Real Estate?

In real estate, promissory notes play a crucial role in the financing process and serves as a written commitment by borrowers to repay the loan. Here are a few instances :

- Creation of the Loan Agreement: When a buyer secures a mortgage to purchase a property, they subsequently sign a promissory note as part of the mortgage agreement. This action formalizes their commitment to repay the loan.

- Lender’s Collateral Protection: Lenders often pair the promissory note with a mortgage or deed of trust. This provides the lender with collateral, typically the property itself.

- Loan Repayment: The borrower makes regular payments, covering both principal and interest, as outlined in the promissory note. This note records the loan and ensures both parties are clear on the repayment schedule.

- Default and Legal Remedies: If the borrower fails to meet the repayment terms, the promissory note grants the lender the right to take legal action. This could lead to foreclosure on the property to recover the loan.

- Transferability: Lenders can sell or transfer promissory notes between themselves. When someone sells a mortgage, they assign the note to the new lender, who collects payments. In real estate, lenders commonly bundle and sell loans in secondary mortgage markets.

Are Promissory Notes Important?

Yes, promissory notes are essential to formalize loan agreements and provide legal protection for the involved parties. They outline aspects such as the loan amount, repayment schedule, and collateral.

The notes ensure clarity and enforceability, allowing lenders to take action in case of default. As you begin the homeownership journey, ensure you are well aware of homebuying terms like promissory notes. Start by browsing homes online.

Frequently Asked Questions

Can promissory note be signed electronically?

Yes, promissory notes can be signed electronically. Electronic signatures are legally valid under the E-SIGN Act and UETA.

Are promissory notes legal?

Yes, promissory notes are legal documents as long as they meet the required legal standards.

How can I get a promissory note?

You can get a promissory note by downloading a template online or consulting a legal professional.