Interest rates have skyrocketed to 6.32% in Q4 2024! But mortgage points can be your solution. These points are upfront fees to reduce your interest rates.

Each mortgage point is equal to 1% of the loan amount, and lowers your interest rate by 0.25%. This can help you save on your overall mortgage costs.

To make your homeownership journey even more favorable, consider getting pre-approved! A pre-approval can give you a clear picture of your loan terms and strengthen your position in a competitive housing market.

What Are Points on a Mortgage?

Mortgage points, also known as points on a mortgage, are upfront fees that borrowers can pay to reduce their interest rates. Each point costs 1% of the total loan amount and reduces the interest rate by 0.25%.

Most lenders allow you to buy up to 4 mortgage points. Points help you save on monthly mortgage payments and overall interest over the life of the loan. However, these benefits depend on how long you plan to stay in your home.

Types of Mortgage Points

- Origination Points: These points cover the lender’s processing costs and do not affect the interest rate. They are essentially fees for originating the loan.

- Discount Points: These points allow borrowers to lower their interest rate. They reduce your monthly payments and total interest over the life of the loan.

How to Calculate Savings With Mortgage Points?

It is crucial to calculate how loan points affect your savings to assess if they are a worthwhile investment.

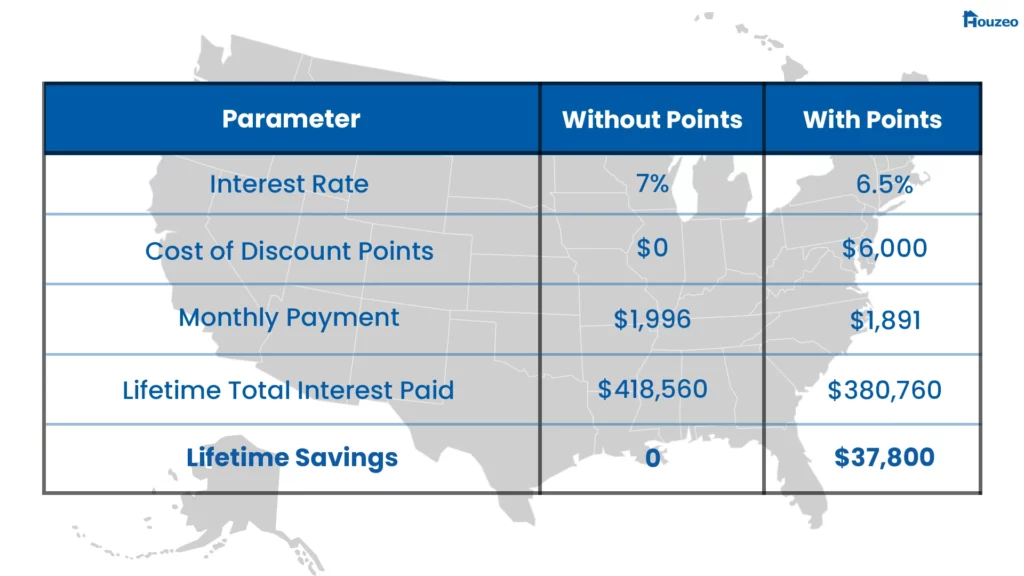

For example, let us consider a $300,000 fixed-rate mortgage with a 30-year term and a 20% down payment. If your interest rate is 7% and you purchase two discount points, then your new interest rate is 6.5%. Here’s how it works:

So, if you invest $6,000 in two discount points, your overall savings can be up to $37,800. However, you must stay in your home long enough to reach the breakeven point and maximize your benefits.

What Are The Benefits of Mortgage Points?

- Lower Interest Rates: The primary benefit of loan points is the potential to reduce your interest rate. Each point lowers your interest rate by 0.25%. This can lead to substantial savings over the life of the loan.

- Long-Term Savings: Loan points require an upfront cost. However, it lowers monthly payments and offers significant long-term savings.

- Tax Deductions: Mortgage points are tax-deductible because they are considered prepaid interest. This can lead to additional savings when filing your taxes. However, consult a tax professional to understand how it applies to you.

- Increased Affordability: A lower interest rate translates into reduced monthly housing costs, which can free up funds for other expenses or savings.

Factors to Consider Before Purchasing Mortgage Points

- Homeownership Timeline: If you don’t plan to stay in the home long-term, the upfront cost may not be worth the investment.

- Break-Even Point: You should calculate how long it will take to recover the cost of the loan points through monthly savings.

- Available Funds: Make sure you have enough cash to pay the upfront price of loan points, along with your down payment and closing costs.

- Market Conditions: In a low-interest rate environment, points may not offer as much value as they would in a high-interest rate environment.

Are Mortgage Points Worth It?

Yes! One mortgage point reduces your interest rate by 0.25%. This lowers your monthly mortgage payments and translates to thousands in lifetime savings.

However, it depends on your homeownership plans and current market conditions. Carefully evaluate the benefits of mortgage points when you shop for your new home. Browse properties online now!

Frequently Asked Questions

Are mortgage points tax-deductible?

Yes. One of the benefits of mortgage points is that they are typically tax-deductible as mortgage interest. However, this depends on specific IRS rules and individual circumstances. Consult a tax professional to know more.

How many mortgage points can I buy?

Most lenders allow you to buy up to 4 mortgage points, but this can vary depending on the lender and the specific loan terms.

What is one mortgage point equal to?

One mortgage point is equal to 1% of the total loan amount and reduces the interest rate by 0.25%. This helps you save on the overall costs of your mortgage.