Nearly 40% of Americans can’t afford the standard 20% down payment on a home. This can be a huge barrier to homeownership. Especially with today’s median house price of $442,525, you have to pay $880,300. That’s huge! That’s where gift letters come into the picture.

Nearly 23% of first-time homebuyers received down payment assistance from relatives. A gift letter can help you get qualified for a mortgage. Apply for a pre-approval now and see how much you can be eligible for. Start now!

What Is a Gift Letter for Mortgage?

A gift letter is a formal document that confirms the legitimacy of money received from friends or relatives. Your donor signs the letter that states that you’re not obligated to pay back the money. You can use your gift money to pay your mortgage down payment. Further, it can also be used to pay closing costs or home renovations.

A gift letter proves that funds received are not an additional loan but rather a gift. It also serves as a confirmation for your lender and verifies the relationship of the source.

What Does a Gift Letter for a Mortgage Include?

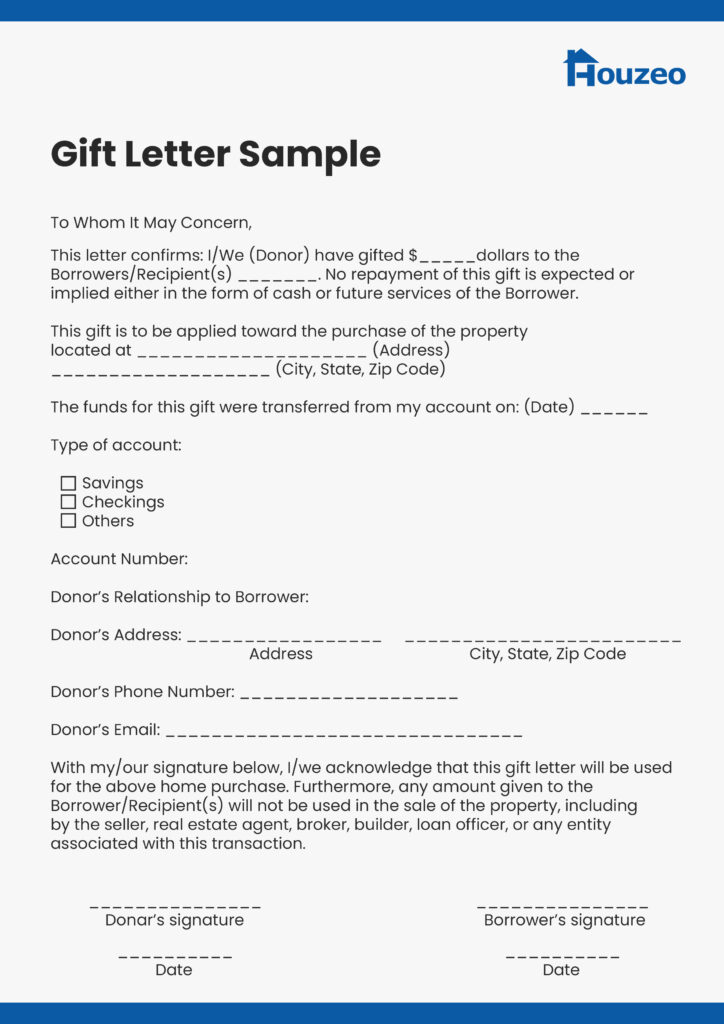

A gift letter for a mortgage is a legal document that adheres to a standard format. A gift letter should entail the following aspects:

- Donor’s Information: Include the full name of the donor, their relationship to the borrower, full address, and occupation.

- Recipient’s Information: Include the full name, relationship to the donor, and their property address.

- Gift Amount: The exact amount of your gift in dollars.

- Confirmation of Gift: A confirmation of gift money with no expectation of repayment and the use of funds.

- Source of Funds: The description of the source of money and their bank account information.

- Date: The date when the funds are transferred.

- Acknowledgment and Conditions: A statement confirming the use of gift money for the purchase of the property.

Here’s a Gift Letter Template for Mortgage:

(Note: This is only a sample gift letter for a mortgage.)

How to Use a Gift Letter for Your Down Payment?

Here are some guidelines to help you use your gift money for down payment:

- Provide Evidence of Gift Money: Inform the lender that the money used for the down payment is a gift, not a loan. Additionally, your donor must sign this letter.

- Cooperate With Lender Inquires: Your lender may ask for additional details to verify the source of funds. This may include your donor’s bank details. Work with your lender and provide all the necessary documentation.

What Are the Gift Letter Regulations?

A gift letter’s regulation for mortgage down payment may differ from loan program and property type.

Gift Regulations by loan type:

- Conventional Loan: You can receive gift money only from immediate and extended family members. These gift funds are allowed for the partial down payment.

- FHA Loans: Family members, close friends, employers, charitable organizations and NGOs can gift. The full amount can be used as a down payment

- VA and USDA Loans: Anyone can give a gift except the person selling you the home or your real estate agent. VA and USDA loans usually don’t require a down payment. Instead, gift money can be used to pay the closing costs.

Gift Regulations by property type:

- Primary Residence: A gift of funds letter must clearly state that the gift is not a loan for

primary residence. - Investment or Second Home Property: You need to provide the gift letter as proof of funds. Since a second home or investment property may require a larger down payment along with additional documents.

How Do Mortgage Gifts Affect the Underwriting Process?

Mortgage underwriting is a step in the loan approval process that assesses your financial health. Generally, a lender verifies your income before granting you a loan. Mortgage gifts affect your debt-income ratio (DTI). Lenders assess DTI to see if you can pay your mortgage.

The higher you put down the gift money for the down payment, the less you’ll need to use your own money from the savings. This will in a way lower your debt-income-ratio.

Further, the underwriting process will entail verified documentation like account statements, gift affidavits, and tax documents. Make sure to provide your account statements as well as your donor’s.

Are There Any Alternatives to Gifts Funds?

If you’re exploring ways to fund your home without gift money, there are several alternatives, including:

- Government Programs: The government offers low down payment assistance on several government loan programs.

- Employee Benefit Programs: Explore your employer’s assistance programs in the form of loans or grants.

- Retirement Plans: You can borrow from retirement accounts, especially employer-sponsored plans like 401(k).

- Savings: You can opt to save money and purchase your home. Use a mortgage calculator to get an estimate of your monthly payments. This will help you budget better.

Bottom Line

A gift letter verifies that the funds are given without adding any new financial obligation for you. Further it helps a lender confirm the source of the down payment funds.

Additionally, ask for your donor’s consent before sharing their details with the lender. A well-curated gift letter will ensure a smooth mortgage process for homeownership. With a clear understanding of how gift letters work, you’re on the way to secure your dream homeownership journey.

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

How does gifting money work for a mortgage down payment?

Gift letter will be required to use gift money for a mortgage down payment. The letter verifies the amount, states it’s not a loan, and confirms your relationship with the donor.

Can I use FHA gift funds for a loan down payment?

FHA gift funds can be used to pay down payments for FHA loans. These funds must come from family members, close friends, and employers.

What does a sample letter for gifting money include?

Gift letter should outline essential details to clarify information for you and the lender. This includes the donor and recipient’s full information, the gift amount, and the source of funds.