Around 83% of home buyers use FHA loans to buy their dream house. Recently the FHA loan limits have increased by $26,000. As per the revised guideline, the FHA loan limit for single-home buyers is $498,257 in most areas. Whereas in high-cost areas the limit can reach up to $1,149,825.

These new flexible limits and low down payment of 3.5% make FHA loans a convenient option for you. FHA loans also offer a more lenient credit score of just 580 compared to conventional loans.

You should use professional lender’s support to get FHA loans. They help ease the process and timeline. Start here! Look for lenders online.

What Is an FHA Loan Limit?

An FHA loan limit determines the maximum amount you can borrow for a Federal Housing Administration-insured mortgage in your area. This limit ensures that the FHA programs can support homeownership. These limits are set annually and vary depending on the county you’re buying a home.

There are two key limits for this loan:

- Floor: This is the minimum amount of “65%” available in most counties across the country.

- Ceiling: This is the maximum amount of “150%” available in high-cost areas.

FHA loans also come with a mortgage insurance premium (MIP). It protects the lender if the borrower defaults on the loan.

FHA Loan Limits 2024

| Unit No. | Lowest Loan Limit | Highest Loan Limit | Alaska, Hawaii, Guam and U.S. Virgin Islands |

|---|---|---|---|

| 1 | $498,257 | $1,149,825 | $1,724,725 |

| 2 | $637,950 | $1,472,250 | $2,208,375 |

| 3 | $771,125 | $1,779,525 | $2,669,275 |

| 4 | $958,350 | $2,211,600 | $3,317,400 |

2024 FHA Home Loan Requirement

They offer flexible guidelines for borrowers who may not avail of conventional loans. Here are the things you need to be prepared for:

- Down Payment: You need to have a minimum down payment of 3.5%. To see how this down payment will affect your monthly payments, you can use a mortgage calculator to help plan your budget.

- Credit Score: You need to have a minimum credit score of 580 to avail of an FHA loan. Borrowers with a credit score of 500 to 579 might still qualify but will have to pay a down payment of 10%.

- Mortgage Insurance Premium: You have to pay an upfront amount of 1.75% of the loan amount. You can pay the amount annually or divide it into months.

- Income and Employment History You need to have a two-year stable employment and income history.

- Debt-To-Income Ratio (DTI): You should aim for a DTI ratio of 43% or less. Some lenders may allow up to 50% if you have a strong credit history or substantial savings.

- Occupancy: FHA loans are only approved for primary residence and not for investment purposes.

- Home Appraisal: FHA-approved appraisers will assess your home’s value. They will check whether it meets minimum safety and quality standards.

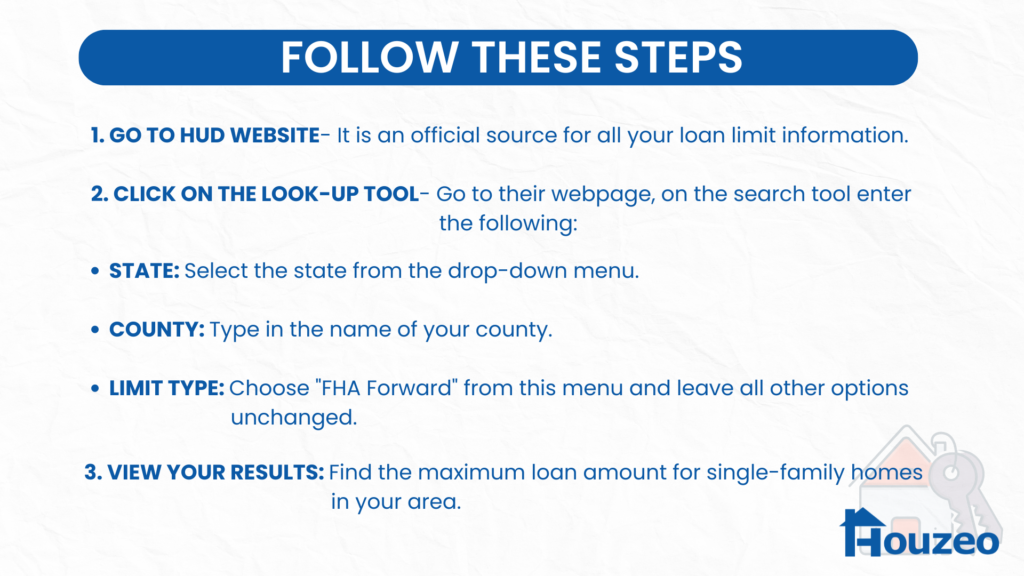

How To Find Your FHA Loan Limit?

The Department of Housing and Urban Development (HUD) sets limits on FHA loans. They use two factors to calculate loan limits: the type of property you’re purchasing and the metropolitan statistical area it’s located in.

How Are FHA Loan Limits Determined?

While these limits are set by the HUD, it’s not a single fixed number, they vary based on these factors:

- Location: Loan limits vary as per region. They have higher limits in high-cost areas and lower limits in low-cost areas.

- Property: Multi-unit properties like duplex or triplex have higher limits compared to single-unit homes.

- Median Home Price: The loan limits for counties adjust based on median home prices. By law, it can’t be lower than 115% of the area’s median home price.

- Conforming Loan Limits: FHA loan limits use “floor” and “ceiling” to describe loan limits. The “floor” is 65% of the national limit while the “ceiling” is 150%.

Tips to Shop for an FHA Loan

FHA loans open doors to homeownership for many. Here are some tips to navigate your FHA loan shopping journey:

- Compare Loan Offers: Check quotes from multiple lenders for the best rates.

- Understand Closing Costs: Ask lenders for a loan estimate to understand the breakdown of these costs.

- Down Payment: Consider paying larger down payments to lower your monthly payment and insurance costs.

- Consider Additional Costs: Understand and adjust mortgage insurance premiums (MIP) and closing costs in your budget. FHA loans require both an upfront and annual MIP.

- Get Pre-Approved: Pre-approval strengthens your case and shows sellers that you’re a serious buyer.

- Ask About Discounts and Programs: Ask about if there are any special programs or discounts for first-time homebuyers or low-income borrowers.

- Be Transparent with Lenders: Disclose and be open about your debts and income fluctuation with your lender. This will help avoid surprises during your application process.

Follow these tips to approach your FHA loan search with confidence. Find the best loan option and make your homeownership a reality.

Bottom Line

FHA loan limits vary between counties according to their median home sale price. The FHA reviews its limits every year. They update them according to market conditions.

If you are a first-time home buyer you must know the limits set for the year and area you are looking for. You must be prepared with your documents and keep a minimum credit score of 580.

If you are looking for a low down payment mortgage and don’t have the best credit scores, an FHA loan can help you. Be aware of the guidelines and requirements that come with these loans.

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

» NEED MORE CLARITY? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

What are the FHA loan limits for 2024?

As per new guidelines the limits for 2024 have increased by $26000. The limits on FHA are $498,257 for low-cost area and $1,149,825 for high-cost areas.

How many FHA loans can you have?

Typically, you can only have one FHA loan at a time and multiple throughout your life. You may qualify for a second FHA loan if relocating far away with limited rentals.

How much of an FHA loan can I qualify for?

The FHA max loan amount you can get in 2024 is $1,149,825. Although, to be qualified for the loan you need to consider factors like your income, credit score, debt-to-income ratio, and your area. You can afford a home loan up to 31% of your gross monthly income.