✏️ Editor’s Note: Realtor Associations, agents, and MLS’ have started implementing changes related to the NAR’s $418 million settlement. While home-sellers will likely save thousands in commission, compliance and litigation risks have significantly increased for sellers throughout the nation. Learn how NAR’s settlement affects home sellers.

58% of homebuyers believe they overpaid for their home. Moreover, 38% home sellers have reduced their asking price to attract more buyers. And 53% sellers are stressed about selling at their desired list price. How to avoid this situation?

The answer is simple. Use comparative market analysis. It helps sellers to set a fair asking price, whereas buyers can buy their dream home in their budget.

If you need more guidance, Houzeo’s platinum packages comes with price assistance. The plan includes a licensed broker who does a detailed CMA. They examine comparable homes in your area and analyze the listing price.

What Is Comparative Market Analysis?

A comparative market analysis is a report that estimates a property’s value. Real estate agents use CMAs to help sellers set listing prices and assists buyers to make competitive offers.

To conduct a CMA, an agent selects a group of similar homes sold recently in your area. These similar homes are called comps, or comparables. The agent then compares the sale price of these comps to give you an estimate value of your property.

Elements of Comparative Market Analysis

You can consider the following elements to determine the accurate comparative market analysis:

- Comparable Properties: Identify recently sold properties that are similar to your property. These comparables should have a similar location, size, and features.

- Property Details: Collect detailed information such as size, condition, age, number of bedrooms, and any unique features.

- Local Market Conditions: Consider factors like supply and demand, trends, and economic indicators.

- Adjustments: Make adjustments to the sale prices of comparable properties to account for differences in features.

- Appraisal Methods: Employ different appraisal methods to arrive at an estimated property value.

- Final Valuation: Based on the adjusted prices of comparable properties, calculate the final estimated value of your property.

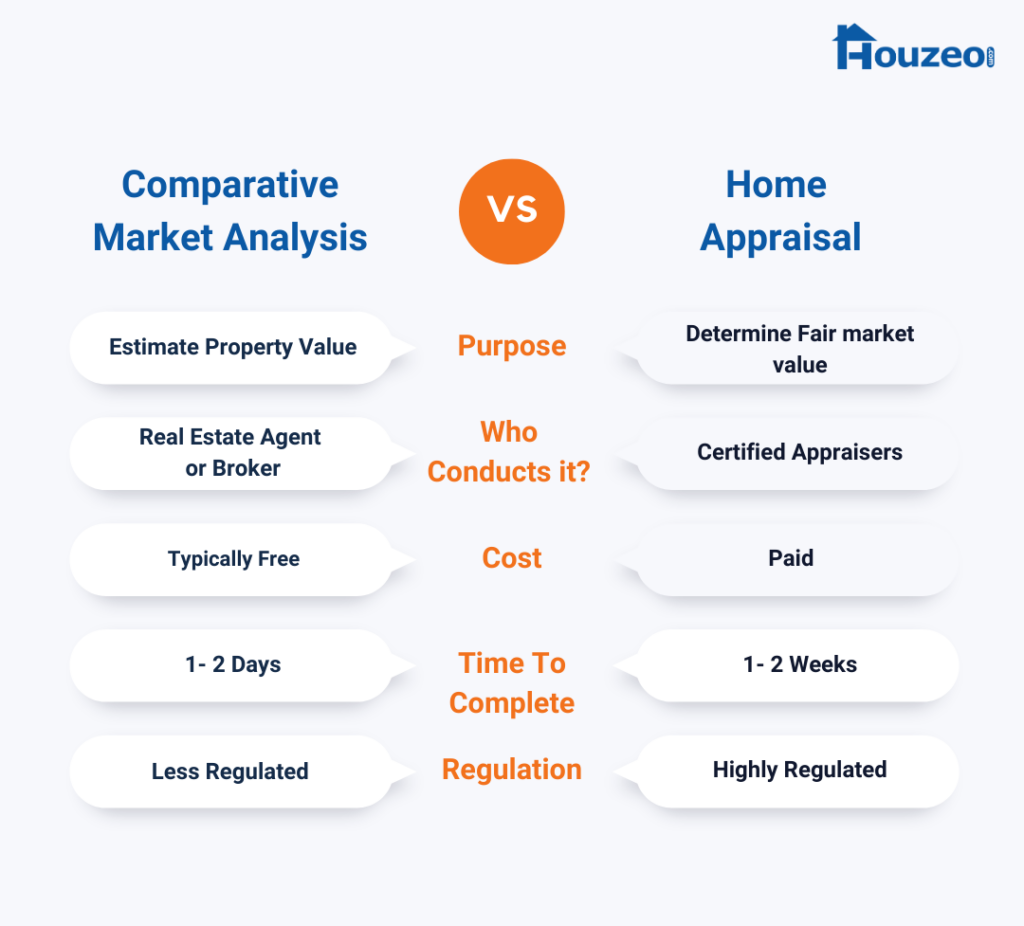

Difference Between CMA and Home Appraisal

Here are the key differences between a CMA and a home appraisal:

In addition to the key differences listed above, there are a few other things to keep in mind about CMAs and appraisals:

- CMAs are typically less detailed than appraisals.

- CMAs do not include an inspection of the property, while appraisals do.

- Lenders are more likely to accept the appraisals than CMAs.

How to Do a Comparative Market Analysis?

Here is a step-by-step guide on how to do a comparative market analysis:

1. Evaluate Your Neighborhood

Get a good understanding of your neighborhood. You can consider the following:

- The overall quality of your neighborhood.

- The proximity to schools, parks, and other amenities.

- The types of homes in your area.

- The recent sales prices of similar homes.

To do this, you can talk to neighbors, or look at real estate websites and public records.

2. Gather All the Property Information

You should have all the information about the comparable properties. This includes property’s address, square footage, number of bedrooms and bathrooms, lot size, age, condition, and any other unique features.

Keep in mind that the comparable properties should have sold recently, within the past 3-6 months.

3. Check the Differences in the Price of Properties

Since no two properties are exactly alike, it is necessary to adjust the comps for any differences. For example, if a comp has a larger lot than your property, the extra land value should be deducted from its sale price.

4. Calculate the Price per Square Foot

To do this, divide the comp’s sale price by its square footage. This will give you a general idea of how much similar properties are selling for in your area.

After this you need to average the price per square foot of all the comps. This will give you an estimated value for your property.

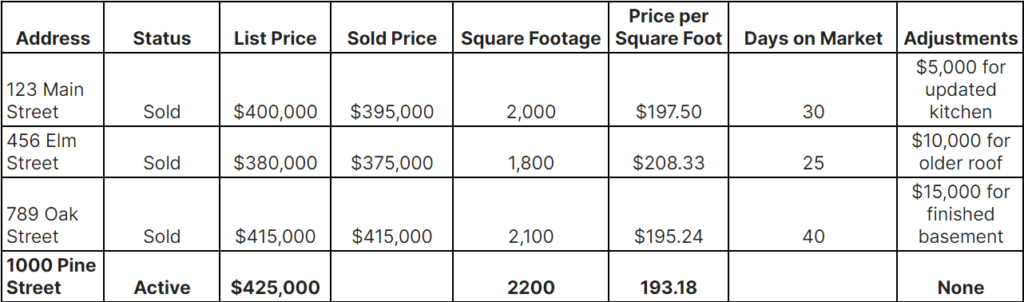

Example of Comparative Market Analysis

Here is an example of a comparative market analysis.

- Average price per square foot: $196.75

- Estimated market value of subject property: $434,500

This CMA table shows information about your and 3 comparable properties. The comparable properties are all similar in terms of size, age, and condition.

It is important to note that a CMA is an estimate of the market value of a property, not an exact valuation.

The actual market value of a property may be higher or lower than the estimated value. This depends on property condition, buyer’s demand, and the negotiation skills of the parties.

Is Comparative Market Analysis Important?

Yes, comparative market analysis (CMA) is important. The CMA report helps you to determine a competitive asking price. If a home is priced too high, it is likely to sit on the market for a long time. If it is priced too low, you may lose out on potential profits.

For buyers, CMAs ensure that they are not overpaying for a home. A lender will also see a CMA to verify the loan amount with the value of the home a buyer wants to buy.

Do You Need CMA?

Yes, you need a CMA. A comparative market analysis report gives you a starting point to price your home. Typically, a real estate agent conducts it, but you can also do it for yourself.

However, it is quite difficult to collect accurate data, analyze them and adjust the difference. Additionally, pricing your own home can be tricky. Worry not! for all the pricing assistance, Houzeo is here to help. Our platinum package comes with a licensed broker, who can help you create your CMA report.

Moreover, you also get pricing assistance, showings management, offer management, and many more to make your selling journey easy.

Frequently Asked Questions

What is CMA in real estate?

A CMA, or comparative market analysis, is a tool to estimate the value of a property. You compare your home to the similar homes that have recently sold in your area.

How do I create a CMA on MLS?

To create a CMA on MLS, search and select comparable properties that have recently sold in your neighborhood. Consider factors such as size, location, condition, and features to analyze the estimate market value of your property.

What is the purpose of a CMA?

The purpose of a comparative market analysis is to estimate the market value of a property. Homebuyers, sellers, and lenders use CMA to get a fair and accurate idea of a property's worth.

How much does a CMA cost?

Typically, CMAs are free of cost. However, some service providers do charge anywhere between $0 to $500.