72%! That’s how many student loan holders believe their debt has kept them from owning a house. 36% of them live with their family because they couldn’t afford one. Does that mean you never get to be a homeowner?

Having a student loan might limit your options to finance a home purchase, but it’s not impossible. Look for a lender that offers suitable terms. Opt for a reasonably-priced home to increase your chances of a lender approving your mortgage.

Can You Buy a House With Student Loans?

Yes, you can! Many people assume buying a house with student debt is difficult due to the mortgage process However, if you manage to keep the credit score above 600 with good creditworthiness, mortgage lenders are more likely to issue a loan. However, keep in mind that multiple loans can have a significant impact on your purchasing power.

⚡3 Key points for first-time homebuyers

- Buyers with student loans spend 19% less on the renovation of their property than buyers without student loans.

- 54.6% is the average DTI for a new graduate.

- $1,668 is the average amount paid for both the student loans and mortgage. In this amount, mortgage has a larger share of 76.44%, whereas student loan has 23.56% of share.

Do Student Loans Affect Buying a House?

Student loans and buying a house are interconnected in several ways. Your student debt may affect:

- Credit score

- Debt-to-income ratio

- Savings

With poor credit scores, a high DTI ratio, and no savings, lenders don’t provide any mortgages.

How to Buy a House with a Bad Credit Score?

A bad credit score significantly decreases your chances of getting a mortgage. However, it doesn’t mean you are disqualified or cannot apply for it. Lenders generally prefer a credit score of 600 and above, but some lenders provide mortgages with a 500 credit score.

Government-backed loan programs generally provide mortgages with low credit scores; FHA, USDA, and VA loans are some examples. In addition, Carrington Mortgage Services, Freedom Mortgage, Flagstar Bank, Movement Mortgage, and Naby Federal Credit Union are some of the lenders that provide loans with 500 credit scores.

Here’s the list of lenders and their credit score requirements.

| Loan Type | Down Payment | Credit Score | DTI Ratio | Mortgage Insurance |

| VA | 0% | No minimum 620 standard | 41% | Not Required |

| USDA | 0% | No minimum 640 standard | 41% | Guarantee fees required |

| Conventional | 3% | 620 | 45% | Required when DP is less than 20% |

| FHA | 3.5% | 500 (10% DP) 580 (3.5% DP) | 50% | Required |

5 Tips for Using Student Loans to Buy a House

Here are a few tips to increase your chances of buying a home with student loans:

1. Improve Your Credit Score

The first step every lender takes to verify your creditworthiness is a credit check. To improve your credit score, you must check your credit report regularly. It helps detect missed payments and any technical errors.

Here are some ways you can improve your credit score:

- Limit credit utilization

- Use old accounts

- Use various credit cards

- Pay bills on time

2. Have a Low DTI Ratio

The DTI ratio helps the lender understand how the borrower is managing the debt. With the help of the 28/36 rule, most lenders decide the borrower’s eligibility. The average DTI ratio of a new graduate is 54.6%.

Here are some points that can help you get a low DTI ratio.

- Refinance the student loan to get better interest rates and monthly installments.

- Get into an income-based repayment program (federal student loans).

- Boost your income.

3. Pay Off Your Debts

If you have small debts like credit card debts and personal loans, consider paying them as soon as possible. Fewer debts decrease your DTI ratio and increase your chances of qualifying for a mortgage.

On the other hand, you can try to lower your student payments. If you have a federal student loan, you can apply for Income-Driven Replacement (IDR). For a private loan, you can apply for refinancing.

4. Look for Mortgage Options

Home loans require considerable down payments upfront. In addition, if you want to avoid Private Mortgage Insurance (PMI), you have to pay a 20% down payment upfront. Try exploring your mortgage options to get a lower down payment. Here are some of them:

- Fannie Mae HomeReady loans

- VA loans

- FHA loans

5. Research State Programs

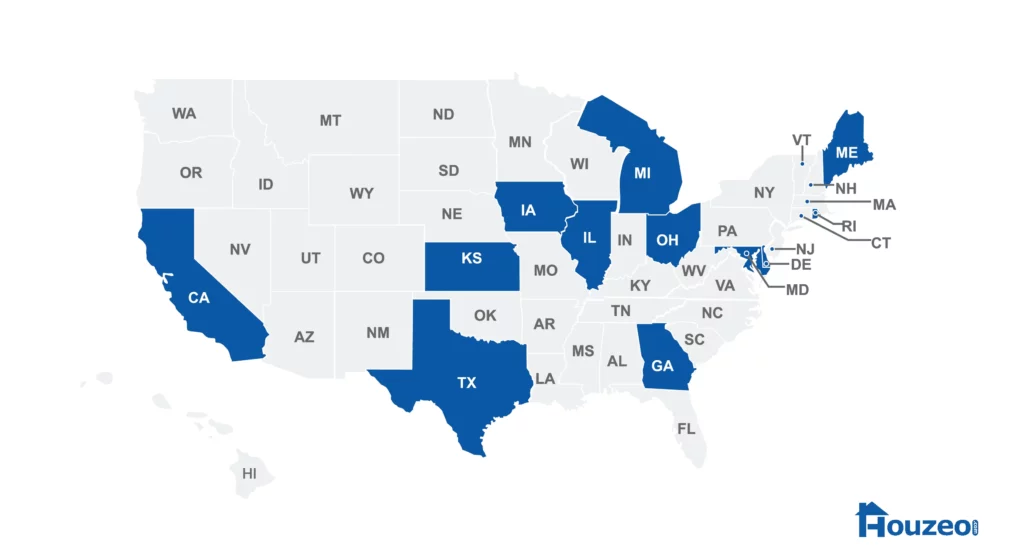

There are state programs that aid first-time homebuyers with student loans. Only 12 states, including Ohio, North Carolina, Georgia, and Maine, have this scheme for first-time home buyers. Eligibility often starts at $1000 for student debt.

Once you’ve improved your credit score and found the right mortgage, it’s time to find your new home. Connect with trusted agents and lenders, and choose from 2.5 million+ homes for sale on Houzeo, America’s best home buying website.

Should You Pay Off Your Student Loans First?

Paying off the loan first can be a good choice, but it depends on your financial status, ongoing interest rates, and more. If you have a low DTI ratio and a high credit score, you can choose a home loan if the market is good.

But first try to calculate your DTI ratio, evaluate your savings, and check your student loan status. If it is possible to pay off the loan soon, then you can opt for a home loan.

Bottom Line

Buying a home with student debt can be a big decision. If you can manage all of your debts, then you can opt for a mortgage. Some lenders approve mortgages with as little as a 3% down payment.

If you feel you have no control over the transaction, Houzeo can be a one-stop solution. With Houzeo, you can look for the best mortgage lenders and get hassle-free approval. Along with the mortgage, Houzeo can also help you discover your home with a wide range of listings.

Find Homes For Sale by Home Type and Style

The market offers a wider range of homes than ever before. But don’t get overwhelmed! Knowing your preferred style can help you narrow your search. Here are some options to target your search by home style:

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.