71.3% of Americans have a good or excellent FICO score. Additionally, 61% of Americans have a good or very good VantageScore. The average credit score for FICO stands at 715, while the average VantageScore is 702.

This suggests that there is a growing trend of individuals aiming to maintain good credit scores. As doing so can increase their chances of qualifying for larger loan amounts and lower mortgage rates.

However, your credit score is reflected in your credit worthiness. So, to determine your creditworthiness, you must get a mortgage pre-approval. It reviews your financial information like credit score and history to give you an idea of how likely you are to be approved for a mortgage.

So, Start here!

What Is a Good Credit Score?

A good credit score ranges between 300-850. It measures how likely the mortgagor is to repay the money or fulfill their financial obligations. A higher digit (above 600) indicates a good or excellent credit scores

Here are the credit scores for different types of mortgages:

- Conventional loans require a minimum score of 620.

- FHA loans require a minimum score of 580.

- USDA loans require a minimum of 620.

- VA Loans have no minimum requirements. However, most of the lenders consider a credit score of 620.

Furthermore, a good credit score also depends on two different models:

- FICO

- VantageScores

What’s a FICO Score?

FICO score is the most widely used credit score model. It is developed by fair isaac corporation (FICO) to determine your creditworthiness.

What Is a Good FICO Score?

A good FICO score is around 670 to 740. FICO score range can be classified in the following categories:

- Fair Range: 580 to 669

- Good Range: 670 to 739

- Very Good Range: 740 to 799

- Exceptional Range: 800+

What’s a VantageScore?

VantageScore is a credit score model developed by Experian, Equifax, and TransUnion. It ranges from around 300 to 850.

What Is a Good VantageScore?

A good VantageScore is also known as a prime-tier score. It ranges from around 661 to 780. Furthermore, VantageScore can be classified in the following range:

- Subprime: 350 to 600

- Near Prime: 601 to 660

- Prime: 661 to 780

- Superprime: 781 to 850

What Are the Benefits of a Good Credit Score?

A good credit score can significantly help you in many ways:

- Lower Interest Rates: A good score of 620 or above justifies your ability to repay. Therefore, lenders will likely offer you lower interest rates below 7%.

- Higher Credit Limits: It can help you qualify for higher credit. For instance, if you have a score of 620 or above you are eligible to get a no-limit mortgage (non-conforming loan).

- Better Loan Terms: You can secure a mortgage with better loan terms like lower closing costs, more negotiating power and easier credit approval.

- No Private Mortgage Insurance (PMI): You have to pay around 0.55% to 1.5% private mortgage insurance on a conventional mortgage. However, if your score is above 620 with a 20% down payment you don’t have to pay PMI.

What Affects Your Credit Score?

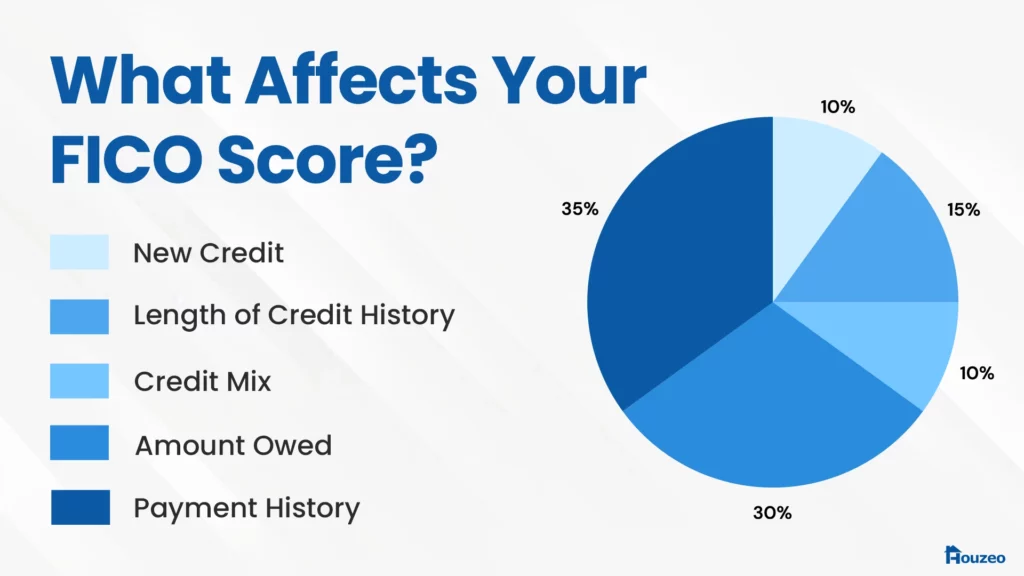

Your credit score is influenced by your ability to repay the loan. Therefore, both models have their factors that affect your credit score. Here are the factors that affect your FICO score:

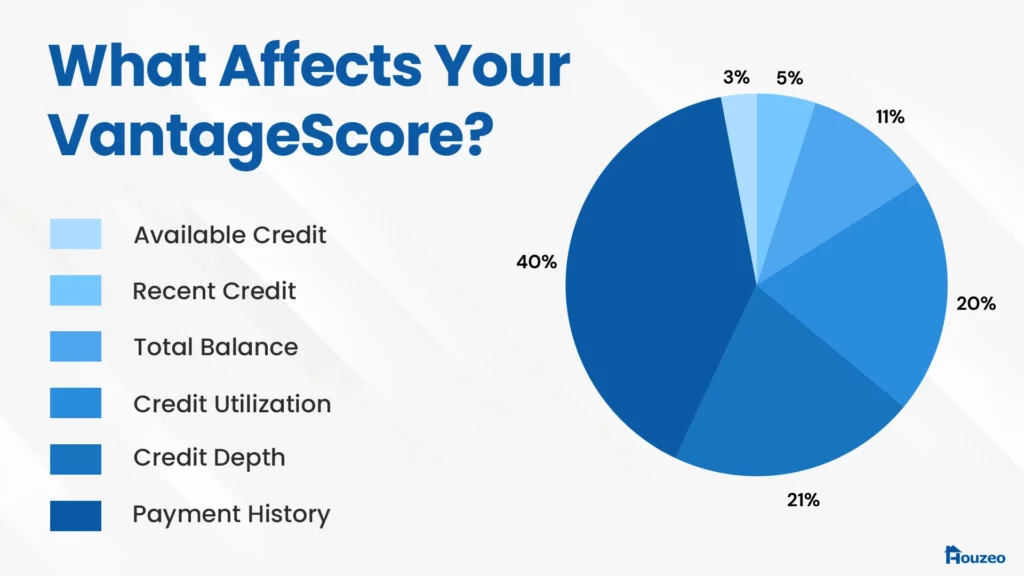

Here are the factors that affect your VantageScore:

How to Improve Credit Scores?

You can try these ways to improve your credit scores:

- Make Timely Payments: Delay on your credit payment stays for 7 years in the credit report. Therefore, make timely payments and enhance your payment history. It assures you are likely to pay your mortgage interests on time.

- Reduce Credit Utilization: A low credit utilization of 35.2% can help you improve your score. Generally, those with a good score have their utilization rate below 40%.

- Maintain Old Accounts: The length of your credit history can improve your scores. Keep your old accounts active as they contribute to your credit age.

- Diversify Your Credit Mix: Diversified credit mix showcases that you can responsibly manage different types of credit. It contributes to your score positively.

What Should Be Your Ideal Credit Score?

Your Ideal credit should be at least 600 or 680. With a good credit score, you can secure better deals on a mortgage. Plus, you can even get competitive interest rates.

With current interest rates below 7%, the housing market is in your favor. So, why wait? With Houzeo, you can secure your American dream of ownership with just a few clicks. Start now!

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

» NEED MORE CLARITY? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

What to do if you have a bad credit score?

If you have a bad credit score, you should look for mortgages that come in your credit score range. However, you can even improve your credit scores by making timely payment and reducing credit utilization.

What is a good FICO score?

A good FICO score is around 670-639. It is determined on your payment history, amounts owed, length of credit history, new credit and credit mix.

What is a good VantageScore?

A good VantageScore is around 661-780. It is determined on your payment history, credit depth, credit utilization, balances, recent credit and available credit.

What is the highest credit score?

The highest credit score is 850 for FICO and VantageScore. It is also called as excellent or maximum credit score.