FHA 203(b) loans are government-backed mortgages that allow buyers to put down as low as 3.5%. You can use the FHA 203b loan to finance your primary residences.

These loans have flexible credit and low down payment requirements. This makes them particularly popular among first-time homebuyers.

To further maximize your benefits, you should get pre-approved! This helps you understand your borrowing capacity and increases your chances to get a loan in today’s housing market.

What Is an FHA 203(b) Loan?

This loan allows buyers to purchase primary homes with down payment as low as 3.5%. The Federal Housing Administration (FHA) insures this mortgage.

The FHA 203(b) loan is popular because it has flexible criteria and allows people with lower credit scores to qualify. This loan provides a more affordable alternative to conventional loans, with lower down payments and reduced additional costs.

What are FHA 203(b) Requirements?

- Credit Score: You typically require a minimum credit score of 580 to qualify for an FHA loan. However, if your credit score is lower than that, you have to pay a higher down payment.

- Down Payment: 3.5% down payment is required for those with credit scores above 580.

- Debt-To-Income Ratio: FHA allows a maximum debt-to-income ratio of 43% to 50%, with some flexibility based on credit history.

- Property Requirements: The property must be a primary home, meet minimum safety standards, and undergo an FHA appraisal. FHA 203(b) loans cover single-family homes, multi-family properties, condos, and specific manufactured homes.

- Employment and Income Verification: Lenders require proof of steady income and employment history, usually for at least two years.

- Gift Funds: FHA permits financial gifts from family or approved sources. FHA gift funds can cover up to 100% of down payment and closing costs.

- Mortgage Insurance Premium: FHA 203b loans require borrowers to pay an upfront mortgage insurance premium as well as monthly premiums.

Who Is Eligible for an FHA 203(b) Loan?

- First-Time Homebuyers: They often go for FHA 203(b) loans due to the low down payment requirements.

- Low-to-Moderate Income Borrowers: FHA 203(b) loans assist individuals and families with lower incomes to achieve homeownership.

- Buyers with Non-Perfect Credit: Buyers with a credit score between 500 and 579 can still qualify, though they must make a 10% down payment.

- Homebuyers Looking to Purchase Primary Homes: FHA 203(b) loans are only available to buy primary residences and not vacation or rental properties.

What are the Benefits of an FHA 203b Loan?

- Easier Approval Process: Buyers with credit issues can qualify more easily for an FHA 203(b) loan.

- Support for Minor Home Repairs: The loan provides funds for homes with minor repairs, such as repairs to exterior decks, patios, and porches.

- Improved Loan Terms: FHA 203b loans typically provide favorable terms compared to conventional loans.

- Increased Lender Choices: A wide range of mortgage lenders offer FHA loans due to their low risk and government backing. This gives you more options to find the best terms.

- No Prepayment Penalties: You can pay off your loan early without penalties. Moreover, foreclosure fees do not apply to early repayment on FHA 203(b) loans.

- Transferable Loan Options: If you sell your home, the loan can be transferred to the buyer.

What Is the FHA 203(b) Appraisal?

The FHA 203(b) appraisal ensures that the property is safe and worth your requested loan amount. Here’s what the appraiser with look for:

- Property Value Estimate: The appraiser will assess the home’s value based on recent sales of similar homes in the area. The goal is to confirm that the property’s value matches or exceeds the loan amount.

- FHA Guidelines: The appraiser ensures the home meets FHA’s minimum property standards, such as safety and structural soundness. Homes with major issues, like foundation and roof damage, may not qualify.

- Required Repairs: If the appraiser finds any issues that don’t meet FHA guidelines, the borrower may need to make repairs before the loan is approved.

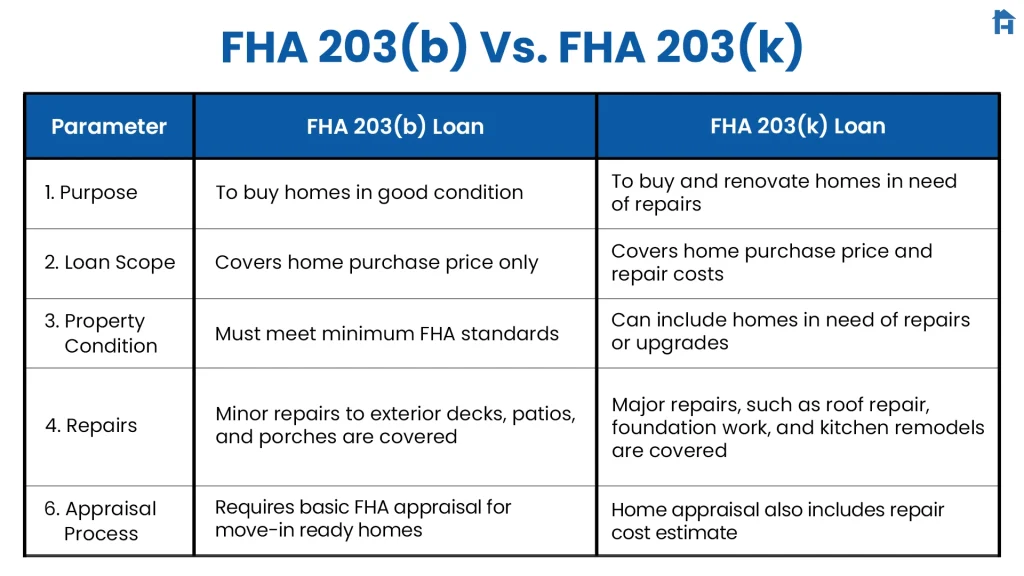

Differences Between FHA 203b and 203k Loans

FHA 203(b) loans focus on standard home purchases, while FHA 203(k) loans are designed for home renovations. Here are the key differences:

Should You Get an FHA 203(b) Loan?

Yes, an FHA 203(b) loan is a great option for first-time buyers. It comes with a low down payment and flexible credit requirements. You can also finance minor home repairs without extra costs.

However, the property must meet safety standards, and undergo an FHA appraisal. If you want to buy a primary home and need affordable financing, the FHA 203(b) loan is a solid choice. Browse properties to start your homebuying journey now!

Frequently Asked Questions

What is FHA 203b loan program?

The FHA 203(b) loan program is an FHA-insured mortgage that helps buyers purchase a primary residence. These loans come with a low down payment and flexible credit requirements.

What is the difference between 203k and 203b?

The difference between FHA 203b and 203k loans is that FHA 203(b) covers minor home repairs, while FHA 203(k) includes major repair and renovation costs.

What is the minimum down payment for an FHA 203(b) loan?

The minimum down payment for an FHA 203(b) loan is typically 3.5%, provided you have a credit score of 580 or above.