Over the last two decades, mortgage approval rates have been low, at 53.2%. In 2023, the average rejection rate of mortgage applications decreased by 2.5 percentage points to 12.1%. In that case, providing a letter of explanation to a lender will help you get loan approval.

A letter of explanation is a document that will explain the reasons; it could be an employment gap, low credit score, inconsistency in income, etc. Providing the LOE to the lender will help you clear the justification behind it and build trust.

Additionally, lenders may offer support by answering questions and helping you gather the necessary documentation.

💰Letter of Explanation for Loan

- For collections, late payments, and serious credit issues like bankruptcies or foreclosures, a letter of explanation is always required.

- Underwriters need letters of explanation for specific application-related problems.

- If you are applying for a mortgage in your name alone but have a joint account with someone else, your lender may also ask you to explain.

What Is a Letter of Explanation?

A letter of explanation for a mortgage is a written, signed, and dated document. It contains information about your application, credit report, and financial background. It also helps to clarify any financial inconsistencies that may hinder your loan approval process.

How Does Underwriting Help Mortgage Applications?

Underwriting helps assess the risk associated with approving your loan. Underwriters use this data with other factors like employment history, income stability, a low credit score, etc.

An underwriter may ask for a letter of explanation to overcome your financial issues with a mortgage loan.

Documents Required for Explanation Letter

Depending on the type of explanation required and the details of your financial situation. Different documents may be needed for an explanation letter (LOE).

- Tax returns

- Bank statements

- Copies of bills

- Termination letters (for gaps in employment)

- Divorce papers

Why Should I Provide a Mortgage Letter of Explanation?

It is important to provide a mortgage letter of explanation if you:

1. Have Employment Gaps: To get a mortgage loan, you should not have any employment gaps. If you do, a letter of explanation is required to explain these reasons. It could be because you are pursuing further studies, have medical issues, etc.

2. Get a Negative Credit Report: If there are any issues with your credit report, a letter of explanation can help. It will state the reasons for low credit scores, late payments, etc.

3. Have Different Addresses: If the address on your driver’s license does not match the address on your loan application. A letter of explanation could help you explain the reason.

4. Report Changes in Income: Underwriters check to see if your income is stable or if there has been a significant increase or decrease in it. You may need this letter from your tax expert to prove your income stability for loan approval.

How Do I Write a Letter of Explanation for a Mortgage?

Here are some of the simple steps to follow for writing an explanation letter:

1: Start your letter of explanation by using the mortgage underwriter’s name or title.

2: Put your name, address, loan account number, and date at the top of the letter.

3: The tone of your letter of explanation should be polite and professional.

4: Include specific details that support your explanation, e.g., dates, names, and any other supporting documents.

5: If the issue involves mistakes on your part, be responsible for them and also show an understanding of the situation.

6: Provide ample details but keep the mortgage letter concise and focused.

7: Conclude the letter on a positive note and express your gratitude once again.

8: Before submitting the letter, review it to avoid errors. If possible, enclose your letter with any supporting documents mentioned in the letter

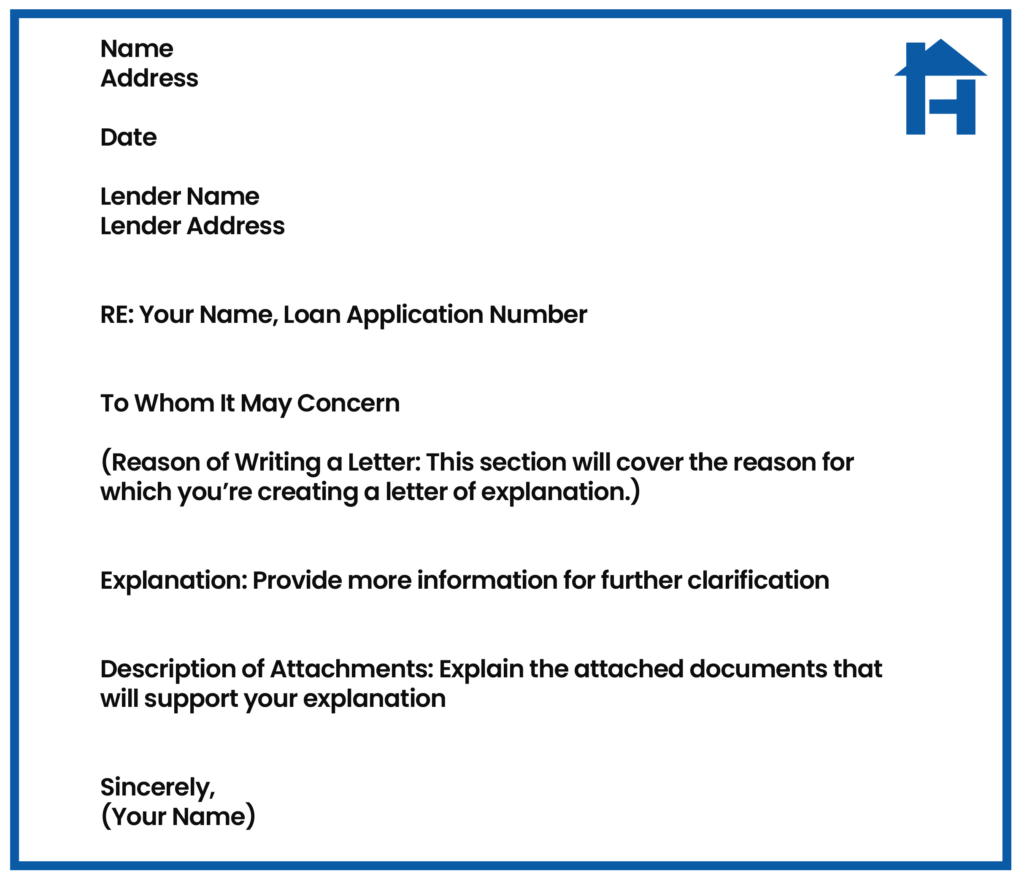

Format of Letter of Explanation

Benefits of Letter of Explanation

A letter of explanation offers several advantages:

- Effective Financial Communication: In financial difficulties, an explanation letter will showcase a positive approach. Also, it will help creditors understand that you’re committed to solving the problem.

- Correction of Errors: When there is a mistake on official documents, a letter of explanation helps to rectify it, such as late payment issues, bad credit scores, etc.

- Mitigation of Legal Issues: In court cases, you can give your side of the story by writing a letter of explanation. It may affect the outcome and make the resolution more agreeable.

Bottom Line

A well-written letter of explanation is a document that can help with your mortgage application. Whether it’s about your credit history or job application this letter allows you to provide important details and context.

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

» NEED MORE CLARITY? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

What details to be included in the letter of explanation for loan approval?

In the letter of explanation, one should include name, address, loan account number, and date.

What should be the length of the letter of explanation?

The length of the letter of explanation should be concise and focused. There is no word limit; generally, one or two pages are enough to explain the circumstances.

Is mortgage approval assured by a letter of explanation?

The approval of a mortgage is not guaranteed by a letter of explanation. But it gives the lender clarity, which may help them make a better choice.

Is it important to include supporting documents with my letter of explanation?

If you mention specific details in your explanation letter, such as names, dates, or any action taken, including supporting documents, it will be easy. It will add more credibility to your letter and provide more clarity to the lender.