Principal and interest are the two main components of your mortgage repayment structure. Understanding interest and principal is essential for every mortgage borrower.

Mortgage payments are the cornerstone of most homeownerships. They determine the money you have to pay regularly to own your home.

In this blog, we’ll explain principal and interest in simple terms, focusing on how they affect your monthly mortgage payments.

⚡Principal and Interest

- Definition: In real estate financing, the principal refers to the initial amount borrowed to purchase a property, while the interest is the additional cost charged by the lender for lending the funds.

- Mortgage Amortization: Mortgage loans are typically repaid through regular installments. Initially, a larger portion of the payment goes towards interest. Over time, the principal increases, gradually reducing the outstanding balance.

- Current Average Interest Rate for a 30-year Fixed Mortgage: Average Mortage rates as of June. 26,2023 is 7.06%.

- Median Home Price: According to Federal Reserve Bank, the median home price is currently $440,300.

What is Principal Payment?

The principal is the amount you borrow from a mortgage lender or bank to purchase a house or property.

Here is an example:

Suppose you want to buy a house that costs $250,000. You decide to take out a mortgage loan from a bank. The bank approves your loan for the full purchase price, meaning the principal amount of your loan is also $250,000.

Now, this $250,000 is the sum you’ll need to pay back to the bank, typically through monthly mortgage payments. You make these payments over a specific period, such as 15 or 30 years. However, the principal does not include additional costs like interest, taxes, or insurance.

As you make your monthly payments, a portion of the money goes towards reducing the principal amount. The principal balance gradually decreases over time as you continue to make regular payments.

What is Interest Payment?

Lenders charge interest as an additional cost on top of the principal amount when borrowers borrow money for a property. Interest is the fee a lender charges for giving you the funds to purchase a home or property.

To illustrate this, let’s continue with the previous example. Suppose you took out a $200,000 mortgage loan to buy a house. In addition to repaying the mortgage principal, you will also need to pay interest over the life of the loan.

Interest is typically expressed as an annual percentage rate (APR). It is calculated based on the outstanding balance of the loan. The specific interest rate you receive will depend on various factors. Such as your creditworthiness, market conditions, and the terms of the loan.

Let’s say the interest rate on your mortgage is 7% per year. This means that, for each year, you will need to pay 7% of the remaining loan balance as interest.

-

⭐ According to Bankrate.com, the current interest rates are 7.23% for 30-year fixed mortgages and 6.59% for 15-year fixed mortgages.

How is Your Interest Rate Determined?

Lenders divide your outstanding balance by 12 and multiply it by your annual interest rate to calculate your monthly interest payment.

Here is an example:

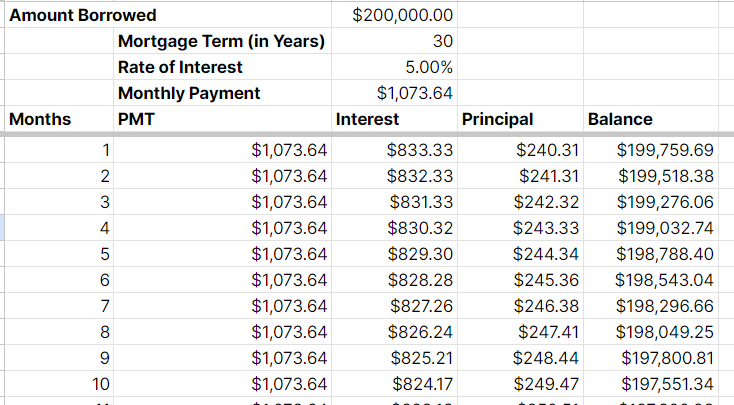

If you owe $200,000 on your fixed-rate mortgage and your rate is 5%, your monthly interest payment would be $833.33 ($200,000 ÷ 12 x 0.05).

Your mortgage lender applies the remaining amount of your payment to your principal. Check out the amortization schedule below to see the principal interest breakdown.

Remember, your credit score, income, down payment, loan type, and location affect the interest rate. Improving your credit score can save thousands of dollars in interest over time!

-

⭐ Adjustable-Rate Mortgages (ARMs) are home loans where the interest rate can change over time, typically after an initial fixed-rate period. This can affect your monthly mortgage payments.

What is Mortgage Amortization?

Mortgage amortization is when a borrower repays their loan gradually through regular monthly payments. Each payment includes both principal (the borrowed amount) and interest (the borrowing cost), with the division changing over time.

Regular payments reduce the loan balance and by the end of the amortization period, your loan is over.

» Download and edit the free amortization schedule Excel template below

Find out with America’s Mortgage Payment Calculator. It gives you an instant amortization schedule and a detailed breakdown of all costs, including insurance and property taxes for free.💲

The Importance of Paying Down Your Principal Balance

Paying down your principal balance is important because it allows you to build equity in your property. Moreover, you can decrease the overall cost of your loan over time. Further, you can potentially shorten the loan term and become debt-free faster.

You can pay extra on top of your regular monthly mortgage payments to bring down your principal balance faster. This process is mortgage curtailment.

What Else is Included in Your Monthly Payment?

A mortgage payment consists of different parts that together determine how much you pay each month. Let’s break it down:

- Escrow: Some mortgage payments include an escrow account. This account holds money for property taxes and homeowners insurance. Each month, a portion of your payment goes into the escrow account to cover these expenses.

- Property Tax: Local governments impose property tax or fees based on the value of your property. You can pay this through your escrow account.

- Private Mortgage Insurance: Borrowers who pay less than 20% as a downpayment may require a PMI. This insurance protects the lender in case of defaults. Until you build enough equity in the house, you must pay PMI per month.

- HOA Fees: If you live in a community with a homeowners association, you may need to pay monthly fees for maintenance, amenities, and community services.

- Homeowners Insurance: Lenders often require homeowners insurance to protect their investments in case of damage or loss to the property. Your monthly payment will include the cost of insurance.

Difference Between Interest Rate and APR

The lender charges an interest on the borrowed amount. On the other hand, APR (Annual Percentage Rate) includes the interest rate plus any additional fees.

The APR provides a more comprehensive view of the total cost of the loan. It includes all costs associated with borrowing the money.

Bottom Line

By understanding the concepts of principal and interest in mortgage loans, homeowners can take proactive steps to pay down their principal and save on interest.

This means making extra payments towards the principal amount whenever possible, which reduces the overall interest paid over time. By doing so, homeowners can potentially shorten the loan term, build equity faster, and save money in the long run!

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest property listing sites in the US. Find condos, townhouses, co-ops, and other types of homes for sale on Houzeo.

» Need More Clarity? Read these exclusive Houzeo reviews and learn why the platform is the best in America’s competitive housing market.

Frequently Asked Questions

1. How is mortgage principal and interest calculated?

Each mortgage payment includes principal and interest. Interest is the cost of borrowing money and is calculated as a percentage of the loan amount. The rest of the payment goes towards paying off the principal.

2. How much interest do you pay on a mortgage?

The amount of interest you pay on a mortgage depends on factors such as the loan amount, interest rate, and loan term. Higher interest rates and longer loan terms result in more interest paid over time.

3. How to calculate monthly mortgage interest?

The formula to calculate the monthly mortgage interest is:

Monthly Interest = (Principal Loan Amount) x (Monthly Interest Rate)

4. How is interest calculated on a 30 year mortgage?

Interest on a 30-year mortgage is typically calculated using an amortization schedule, which breaks down each monthly payment into principal and interest components

5. How to calculate principal payment on mortgage?

The formula for principal payment on a mortgage is:

Principal Payment = Monthly Payment - Monthly Interest Payment