Tampa’s home prices rose another 2.5% in Jan 2025, reaching $410,000. If you’re looking to sell your home, now is a great time. But record home prices also mean record realtor commissions. On a typical Florida home, you’ll pay up to $24,000 in commission.

But it’s 2025. Selling a house in the Cigar City is easier than ever. You don’t need a full-commission realtor to get top dollar for your home. Follow these simple steps to list on MLS in Florida, attract buyers quickly, and save thousands!

8 Steps to Selling Your Home in Tampa

Selling a home can be tricky for first time home sellers. There are challenges at every step, from initial valuation to final negotiation. Follow these steps to navigate through the process seamlessly.

Step 1: Enhance Your Curb Appeal

98% of NAR members believe that great curb appeal can accelerate your home sale. To make a good first impression, mow the lawn and take care of any pest infestations you may have.

A pre-listing inspection can help you identify undiscovered issues in your property. A home inspection in Florida typically costs $425.

Step 2: Know Your Home Selling Options

Here are 4 home selling options that you can choose from based on your level of expertise:

- Discount Real Estate Brokers: Florida discount real estate broker offer quality service at reduced costs. Their commission rates typically range between 0.5% and 2%.

- Full-Service Realtors: Traditional agents provide services from listing to closing and their commission rates are 5% to 6%. This seems excessive, especially when most of these tasks can be handled independently in today’s digital age.

- Cash Buyer Companies: If you want to sell your home fast in Tampa, consider selling it with a cash buyer. However, you may get offers lower than your home’s Fair Market Value (FMV), sometimes as much as 30% to 70%.

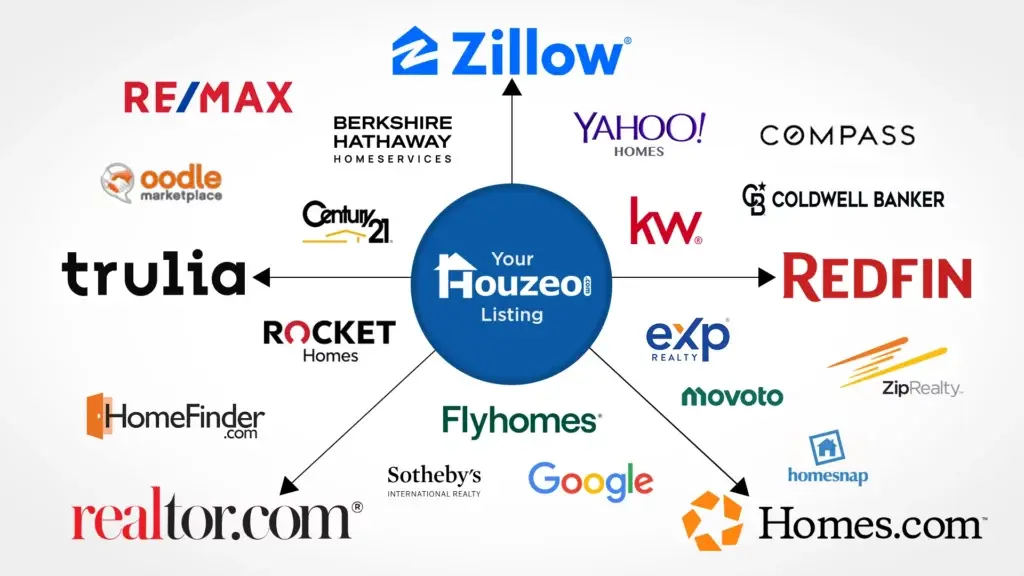

- Flat Fee MLS: With a Florida Flat Fee MLS company, your property will be on the MLS for as low as $399. You can further enhance your listing with optional services like virtual tours and professional photography.

Step 3: Price Your Home Competitively

34.6% of Tampa home sellers had to reduce their asking prices in Jan 2025. Inaccurate pricing led to more days on the market and potentially cost them top-dollar offer.

While in a buyer’s market, you could price your home slightly below FMV, Tampa is currently a seller’s market. Homes are selling faster, with the median days on the market increasing by 10 days, from 38 to 48 days. So, to attract competitive offers, price your home up to 10% more than its market value.

Step 4: Make Your Home Market-Ready

A presentable home is more likely to attract multiple offers and sell quickly. Follow these tips to maximize your home’s appeal and attract top offers:

- Stage Your Home: Staged homes can sell up to 70% faster and for 17% above the asking price. A curated decor and organized layout help buyers visualize living in the home.

- Invest in Professional Photography: Tampa real estate photographers can elevate your listing by showcasing your home’s unique features. A visually stunning listing will attract more buyers and lead to a faster sale.

Now that your home is market-ready, don’t wait any longer. Hurry and sell it immediately!

Step 5: Market Your Property Effectively

While the MLS provides significant exposure to your home, you can also leverage other tools to advertise your listing to other potential buyers. Here’s how:

- Craft a Captivating Property Description: A well crafted listing will capture buyer interest. Write a catchy headline with an engaging description and don’t forget to use adjectives like “flawless” and “spacious” to entice buyers.

- Host Open Houses: It is a powerful tool to connect with potential buyers. 4% of homebuyers found their dream home through an open house. To increase your home’s visibility, consider to schedule them on weekends.

- Add a Yard Sign: When you place a FSBO yard sign, chances of buyers finding your home increases. The sign features your name, contact details, and property description.

Step 6: Handle Showings and Offers

Once your Florida home is listed, prepare it for showing. Don’t rush to accept the first offer, consider these factors before making a decision:

- Is the buyer making a cash offer on your house?

- Has the buyer applied for a mortgage? Is it pre-approved?

- Is the buyer willing to waive off some contingencies like home appraisal?

Step 7: Close the Deal

After you’ve finalized the offer, the next step is to close the deal. Real estate attorneys or Tampa title companies act as closing agents. Take a note of the costs you need to pay when closing the deal:

- Transfer Tax: You need to pay a one-time fee when transferring ownership. The transfer tax generally costs less than 1%.

- Property Tax: You are generally charged approximately 1% of the total home sale value. You can also claim a rebate if you have paid your property tax a year in advance.

- Closing Costs: You and the buyer pay separate closing costs. Seller closing costs in Tampa include HOA, real estate attorney, and home warranty fees.

Step 8: Transfer the Ownership

To transfer ownership, you’ll need to sign essential documents like the escrow paperwork and title deed.

Once these formalities are complete, the buyer transfers all the funds to the escrow company, who then releases the funds to you. The process is officially concluded when the buyer’s name is recorded as the new owner in public records.

Should I Sell My Tampa Home Now?

Yes! Now is the best time to sell a house in Florida. High demand coupled with fewer homes available for sale is creating a competitive environment. This leads to higher selling prices and quicker sales. Don’t miss your chance to make the most of this hot market.