The current median home sale price, $453,000 is sluggishly growing at 4.8% YoY. Moreover, homes are sitting on the market for 23 days. This indicates that the real estate market in the Free State is now slightly less competitive.

Additionally, only 619 homes sold in June 2024, down from 6,967 in the previous year. Sellers are receiving fewer offers. This decline suggests sellers are receiving fewer offers, mainly due to the recent NAR settlement. Concerns about selling prices and agent compensation have contributed to this market sluggishness.

The NAR settlement has removed the buyers’ agent compensation and many MLS. This may drive down home prices further. As a result, buyers will have improved affordability along with low mortgage rates.

Here are some tips for you to sustain in Maryland’s housing market:

- If You Are a Home Buyer: With an inventory of 18K properties and and the potential for further price drops, now is a good time to buy your new home. The low interest rates at 6.99%-5.25% are now in your favor. Consider negotiating for seller concessions to further benefit from the purchase.

- If You Are a Home Seller: The correction in the home prices is long overdue. In the wake of NAR settlement, home prices may drop a little more. If you’re a seller, you can still make profits on home sale before prices potentially drop.

So, How Is the Real Estate Market in Maryland?

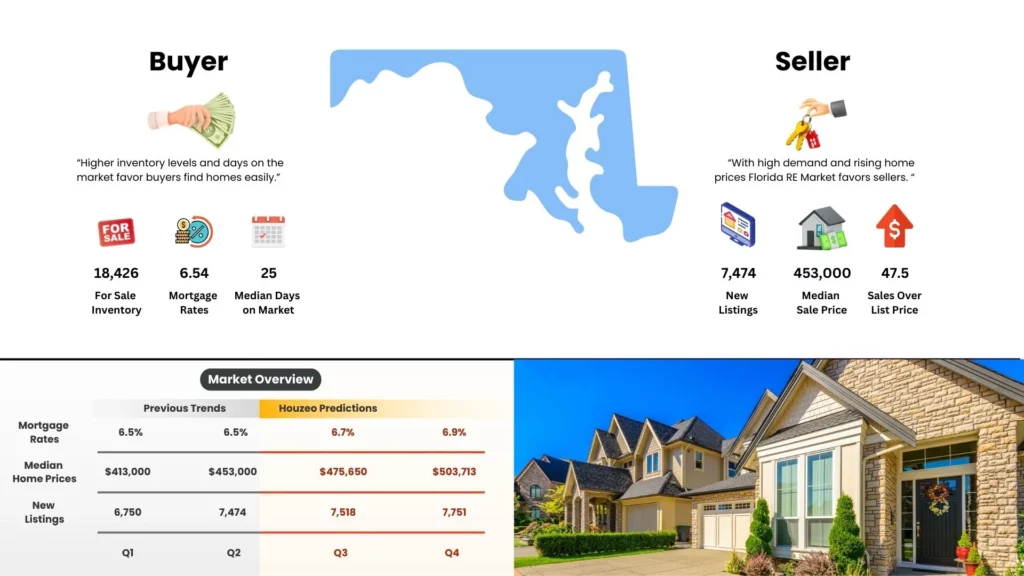

Balanced! The number of homes for sale increased in June 2024 by 12.3% compared to 2023. It’s been consecutively growing for the eighth month in a row. Single-family homes for sale are up by 8.8% and condos are up by 22.9%.

- Median Days on Market: The median days on the market for homes for sale are 23 days, up by 3 days YoY. This trend suggests a cooling demand in the Maryland real estate market.

- Housing Inventory and Supply: As a buyer, you have more options now as the housing inventory is up by 14.2%. There are 18K homes for sale in Maryland with an average supply of 2 months.

- Average Home Prices: The median home price in Maryland is $453,000. But, it is expected to decrease due to a rise in inventory in the latter half of 2024. The sale-to-list price ratio is at 101.4%, dropping by 0.37 pt YoY.

- Home Sales: As per June 2024 data, home sales increased by 12.3% YoY! Only 6,348 homes were sold, down from 6,967 in June 2023.

- Average Rent Prices: Rental costs vary statewide. An average tenant in Baltimore pays $1,550, while the one living in Columbia pays $2,047. You should check the rent rates in your region.

Why Is Maryland a Buyer’s Market Now?

Buyers have more housing inventory to explore. The additional housing supply can balance the market and keep the home prices in check. Let’s look at some more facts:

- More Days on the Market: Homes are spending more days on the market. This is visible in metro cities like like Baltimore, Columbia, and Rockville, where the average days on market is between 6 to 36 days.

- Low Housing Demand: The demand in Bethesda is low with only 83 homes sold in June, down from 105 last year. Similarly, only 100 homes were sold in Columbia, down by 20% from last year.

- More Homes Have Price Drops: In June, 27.4% of homes experienced price drops, compared to 23.8% last year. This trend indicates a gradual shift toward a buyer’s market.

- Low Mortgage Rates: Mortgage rates remain near historic lows, ranging between 6.90%-5.37%. So, this is a great time to lock in a low rate and get pre-approved for a mortgage now.

Maryland Housing Market Predictions 2024

Here are the predictions for Maryland’s housing market in the remaining months of 2024 and 2025:

- Number of Home Buyers Will Increase: As inventory grows and homes stay on the market, more home shoppers are expected to re-enter the market.

- Interest Rates are Expected to Drop: Mortgage rates hit 6.34% in July, 2024. NAR predicts the average interest rate will drop to 6.3% by year end. It will attract more buyers to apply for the loans.

- New Home Constructions Will Shoot Up: 33.4% of single-family homes for sale in Q1 were newly built. This rise in home construction will continue due to increased demand from remote workers and favorable mortgage rates.

- Home Prices Will Drop: After a period of sluggish growth, home prices are expected to begin a gradual decline.

- iBuyers Will Continue to Make Lowball Offers: iBuyers like Opendoor and Offerpad, which once offered 104.1% of market value in 2021, now offer around 70%. Such lowball offers to sellers will increase opportunities for individual buyers.

Bonus Predictions: Buyer Broker Commissions Will Be Zero!

In a shocking turn of events, the NAR settlement has completely eliminated buyer agent fees from the MLS. Let’s understand its impact:

- Buyer Agents Will Be Affected: With buyers now responsible for directly paying their agents, many may choose to find their homes on their own. This may very soon render buyer agents obsolete.

- Seller Concession Will Increase: Without the obligation to pay buyer agent commissions, sellers might see increased requests for seller concessions. and offline transactions. Additionally, builders are offering significant concessions to attract buyers, further influencing the market dynamics.

- Builders Will Compete More: Home builders are persuading buyers to buy new construction homes with mortgage buydowns worth $30K!

- Sellers May Offer Fees for Services: Sellers may offer at least 1%-2% fees to the buyer agents in order to sell homes quickly. Increasing competition from builders may also cause sellers to pay extra fees to buyer agents.

Curious what the NAR lawsuit is about?

Check out our video to find out why NAR chose to settle and eliminate the buyer-broker compensation rule.

Is the Housing Market in Maryland Going to Crash?

A housing market crash in Maryland is unlikely. Maryland home values have been increased to 4.0% over the past year. Analysts predict this positive trend will continue over the next 5 years.

Maryland’s income tax rate is a cherry on the top that range from 2.00% to 5.75%. Maryland’s job market is also strong. The unemployment rate is only 2.8%.

This affordability, combined with strong economic fundamentals, makes a housing market crash in Maryland’s unlikely.

2024: Is It a Buyers’ or Sellers’ Market Now?

The housing market is expected to lean more in favor of the buyers in the latter half of 2024. Home prices are rising slowly, and the number of homes for sale has increased by 14.2% year over year. Buyers now have more choices.

With mortgage rates around 5.87%, buyers have more purchasing power. Consequently, more homeowners are likely to list properties on Maryland MLS. The 1.1% increase in new active home listings in Maryland has also brought back home shoppers.

So, whether you are looking for a condo in Baltimore or a single-family primary home in Columbia, you will find your dream home in the coming months.

Find Your New Home With Houzeo

With thousands of property listings, Houzeo.com is one of the biggest home listing sites in the US. Find condos, townhouses, co-ops, and other homes for sale on Houzeo.

Disclaimer: This article is for informational purposes only. It does not constitute an offer, solicitation of an offer, or any advice or recommendation. Houzeo doesn’t provide any legal or financial advice. The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Houzeo Corp., its affiliates, or its employees. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any investment decision.

Frequently Asked Questions About Maryland Real Estate Market

When will the housing market crash in Maryland?

Not for the next few years. Maryland's housing market will not crash in 2024. Despite low housing demand and modest home prices, Maryland's market is afloat.

What are the real estate housing market 2024 predictions for Maryland?

2024 is a balanced market with 5-6 months of supply. Here's our forecast for Maryland's housing market in 2024 are: (1) Home buyers have returned to the market. (2) Housing inventory will increase. (3) Property prices in Maryland will increase marginally.

Are home prices dropping in Maryland?

Not yet! Currently the property prices in Maryland are increasing but at a slow pace of 5.4% YOY. However, you can still find the cheapest places to live in Maryland. You can find the value of your favorite homes on Houzeo's home value estimator.

Is it a good time to buy a house in Maryland?

Yes! Currently, the homes for sale are at around 18K which is up by 14.2% YoY. Low home prices and low mortgage payments have made the home buying affordable. More buyers will return in the second half of 2024, so we'd recommend you to buy a house now.